The technical analysis of week 44 explores the extraordinary market conditions, including speculative attack towards FTX and the consequent black swan scenario. Additionally, we assess a selection of technical and fundamental indicators, as usual.

Bitcoin Still Resilient Amid The FTX Drama

The digital asset markets were surprised by FTX’s potential insolvency, stemming from the exchange war between rival Binance and FTX. In a bigger picture, the two competing exchanges have been at war with each other for years, and the recent events are just an escalation of the long saga. The dominant digital asset exchange, Binance, seemingly launched a speculative attack against the FTX exchange’s native token, FTT, potentially dumping a total of 23 million units. Consequently, the FTT started showing signs of significant weakness during early European morning hours, dropping -75,8 percent in 24H. FTT has now weakened by -79,5% within the past seven days.

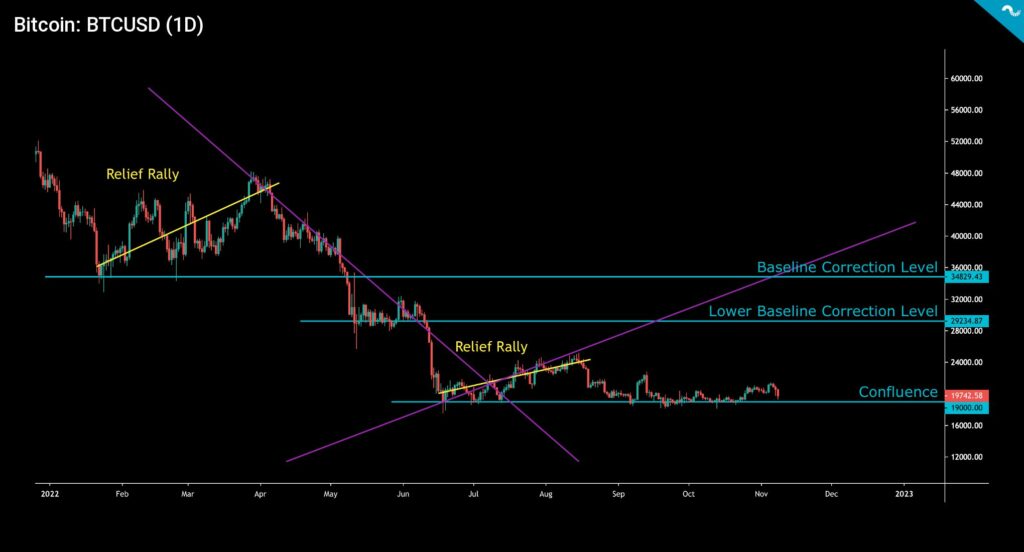

Amid all the mayhem, bitcoin’s market reaction has remained relatively calm, weakening only by -10% within 24 hours. Bitcoin is still trading around its multi-year confluence level (turquoise, low) at $18-19K. If the risk environment doesn’t escalate further, we might see bitcoin rising toward the lower baseline correction level (turquoise, middle). In that scenario, bitcoin would aim for the $28-29K level, which is also Deutsche Bank’s target price for 2022.

Ether has weakened notably more than bitcoin, as markets were scared by Changpeng Zhao’s Ethereum-related tweets. The ether token is down -15,7 percent on a weekly basis. This week breaks ether’s 3-week long streak of spot price hikes, as ETHUSD strengthened notably between weeks 41 and 43.

#Binance has about $8 billion ETH in our cold wallets 1 & 2.

— CZ 🔶 Binance (@cz_binance) November 7, 2022

Surprisingly, Litecoin has been able to keep its head above the surface, rising almost 4 percent from last week. The price performance of other cryptocurrencies seems divergent, mainly ranging between -10 and 10 percent. While the leading stock market index S&P 500, weakened slightly in a week, gold was able to gain 1,63%.

7-Day Price Performance

Bitcoin (BTC): -9,6%

Ethereum (ETH): -15,7%

Litecoin (LTC): 3,9%

Aave (AAVE): -13,1%

Chainlink (LINK): -5,5%

Uniswap (UNI): -13,7%

Stellar (XLM): -11%

XRP: -12,6%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -1,68%

Gold: 1,63%

– – – – – – – – – –

Bitcoin RSI: 55

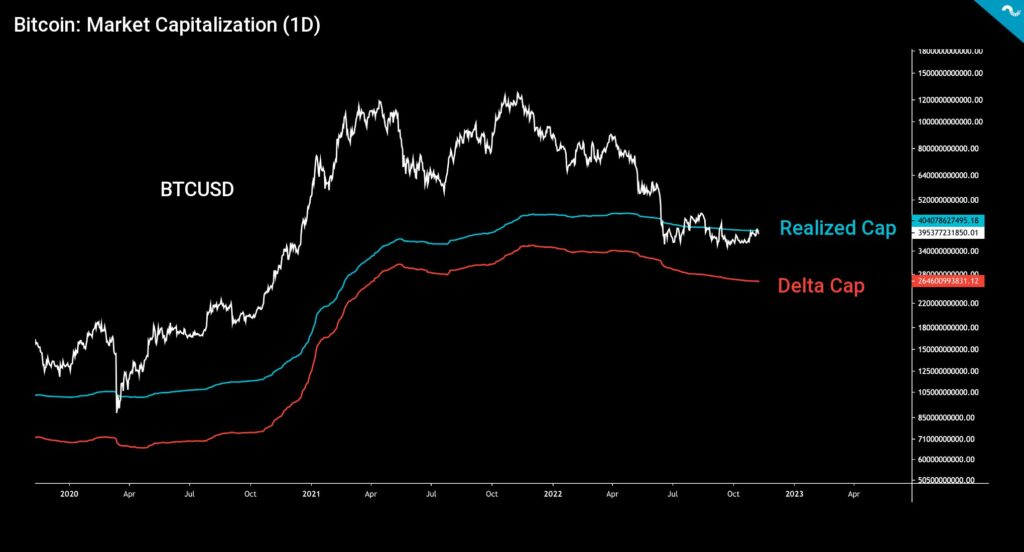

Despite the recent spot price drop, bitcoin’s market capitalization (white) is still aligned with the realized cap (turquoise). Bitcoin’s market cap was momentarily able to cross the realized cap during the summer, signaling positive momentum. The delta cap (red) acts as a support of last resort.

FTX Under a Speculative Attack

As mentioned before, the rivalry between FTX and Binance exchanges dates back to the year 2019, when FTX was created. Founded two years before FTX, Binance had an epoch of sovereign dominance between 2017 and 2019. FTX posed a notable threat to Binance’s existence, and the latter tried to hedge the risk by strategically investing into the competitor. However, Binance later divested from FTX during its $900 million funding round. Until very recently, FTX was the second largest exchange after Binance and competition escalated into new dimensions.

FTX’s major investors have been:

- Alan Howard

- BlackRock

- Circle

- Multicoin Capital

- Ontario Pension Fund

- Paradigm

- Ribbit Capital

- Sequoia Capital

- SoftBank

- Tiger Global

- VanEck

- Temasek

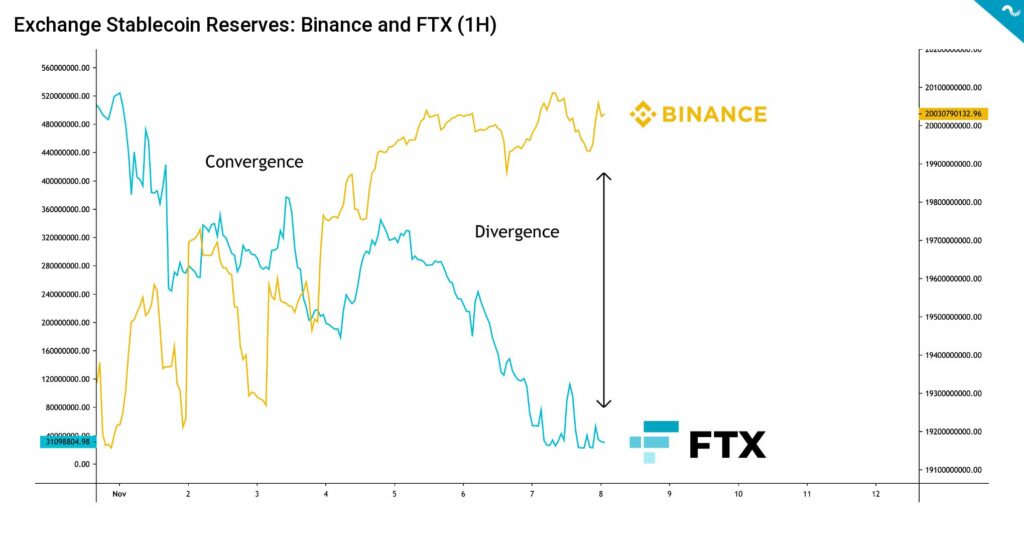

After FTX’s Sam Bankman-Fried tried to leverage his governmental connections in order to elevate the exchange, Binance’s Changpeng Zhao (CZ) decided to act. CZ threatened to dump at least 23 million FTT tokens into the relatively illiquid market in order to weaken FTX’s position. During the following days, the stablecoin reserves of both exchanges (embedded chart below) started to diverge in favor of Binance, as FTX increasingly needed to protect the valuation of its FTT token.

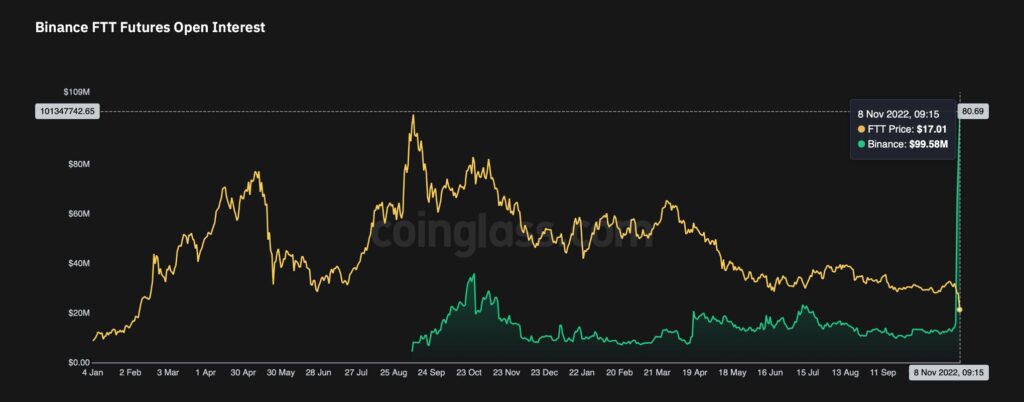

Additionally, the FTX Token was strongly shorted on exchanges, and the open interest of Binance’s FTT futures reached $99,58 million, the highest value since November 2021. Despite all this, some analysts believe that CZ actually never sold any FTT, and the written threat (tweet) alone was enough to realign the markets in his favor.

As the digital asset market is known to be highly correlated, the damage wasn’t only limited to the FTX Token. Bitcoin’s futures market experienced over $614 million worth of long liquidations on November 8th, the highest number since spring’s correction.

Narrative Shift: Binance Buys FTX

Amid the significant downfall of the FTT, Binance suddenly offered to help FTX in its “liquidity crunch”. Changpeng Zhao proposed to buy the FTX to recover the exchange and its clients. According to Bloomberg, both FTX and Alameda Research were given a value of one (1) dollar. Semafor later revealed that in the hours before FTX secured rescue financing from Binance, the crypto exchange sought a bailout of more than $1 billion from Silicon Valley and Wall Street investors. Terms weren’t disclosed. Two of the people briefed on Bankman-Fried’s efforts said the firm was seeking more than $1 billion in financing before the Binance deal was sealed. And apparently, on Tuesday, the balance sheet hole appeared far deeper, closer to $5 billion to $6 billion.

This afternoon, FTX asked for our help. There is a significant liquidity crunch. To protect users, we signed a non-binding LOI, intending to fully acquire https://t.co/BGtFlCmLXB and help cover the liquidity crunch. We will be conducting a full DD in the coming days.

— CZ 🔶 Binance (@cz_binance) November 8, 2022

The Possible Contagion

Investors are now obviously afraid of the possibly spreading contagion of FTX and Alameda Research. According to The Information publication, the fate of FTX’s venture capital investors remains unknown, and they are still trying to figure out how the Binance deal would impact them. Another investor said they were fielding texts from limited partners throughout the day, with institutional investors worried about the value of stakes going to zero. Alameda Research still holds a repertoire of tokens (embedded list), which would potentially be affected by the meltdown.

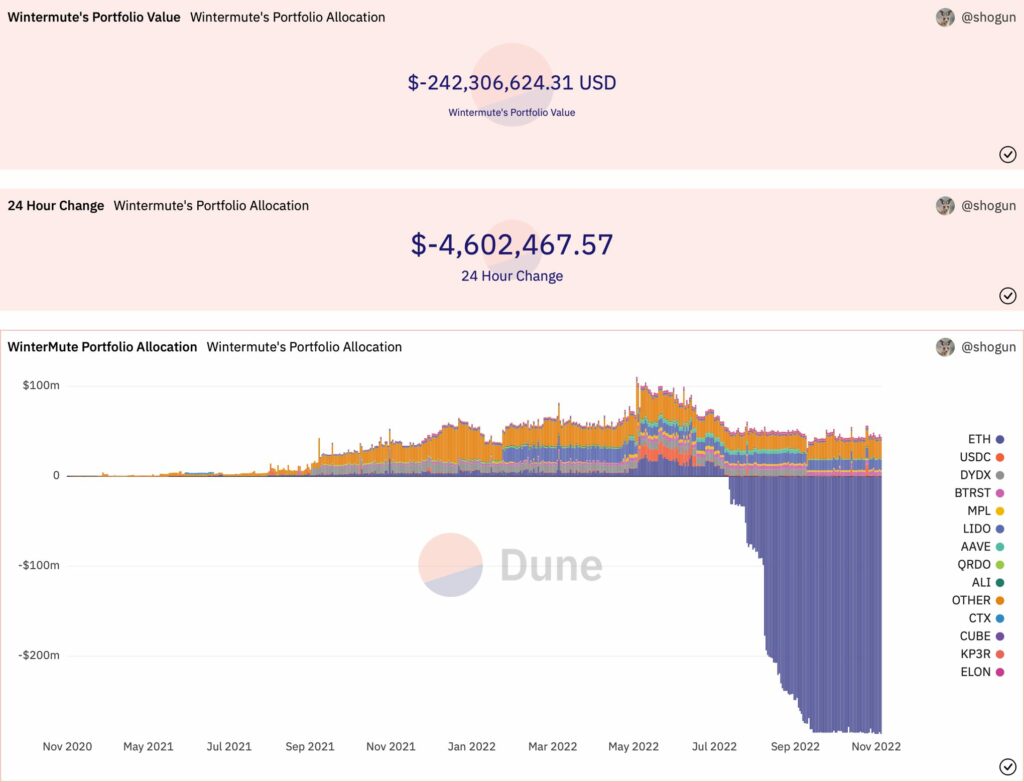

Additionally, there are ominous rumors of the global crypto market maker Wintermute being insolvent, with its portfolio value being -242 million dollars. Wintermute was previously hacked for at least $160 million, and the company is heavily indebted to multiple DeFi platforms.

What Are We Following Right Now?

FTX might have provided a massive bailout for Alameda Research during the second quarter of 2022.

1/ I found evidence that FTX might have provided a massive bailout for Alameda in Q2 which now came back to haunt them.

— Lucas Nuzzi (@LucasNuzzi) November 8, 2022

40 days ago, 173 million FTT tokens worth over 4B USD became active on-chain.

A rabbit hole appeared 🧵👇 pic.twitter.com/DtCyPspME0

The self-regulatory body of China’s interbank market said on Tuesday it will expand bond financing for private firms, including developers, with support from the central bank.

China will expand bond financing for private companies, including private property developers https://t.co/ecQT8DhAim pic.twitter.com/yA2Fb9aJfR

— Cathy Yuan Zhang (@CathyYuanZhang) November 8, 2022

13 percent of Canadians owned bitcoin in 2021, up from only 5% in 2020.

13% of Canadians 🇨🇦 own #bitcoin pic.twitter.com/nGXGiWFdKv

— Documenting Bitcoin 📄 (@DocumentingBTC) November 8, 2022

Following the speculative attack against FTX, BitMEX introduced two new FTT perpetual contracts.

Boom 💥.

— BitMEX (@BitMEX) November 8, 2022

New FTTUSD and FTTUSDT swap listings are LIVE on BitMEX.

FighTT or no FighTT, users can now long/short $FTT $USD and $FTT $USDT, with up to 50x leverage.

Contract deets: https://t.co/7UkiQ57Ki1 pic.twitter.com/7UtvENWSxK

Learn from our previous TA’s

- Technical Analysis: Is Altseason a Possibility?

- Technical Analysis: Bitcoin Approaches a New Pool of Liquidity at $20K

- Technical Analysis: Uptober or Sidetober?

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!