The technical analysis of week 46 examines bitcoin’s rapidly approaching halving schedule and the recent challenges faced by the Binance exchange. Additionally, we explore bitcoin’s three technical turning points for Band, the crypto-related stock rally.

The digital asset market has continued its sideways movement since last week, with bitcoin weakening by about one percent. In the market that showed strong growth in early November, there is now a slight uncertainty stemming from regulatory risks, as Binance’s Changpeng Zhao (CZ) faces new charges.

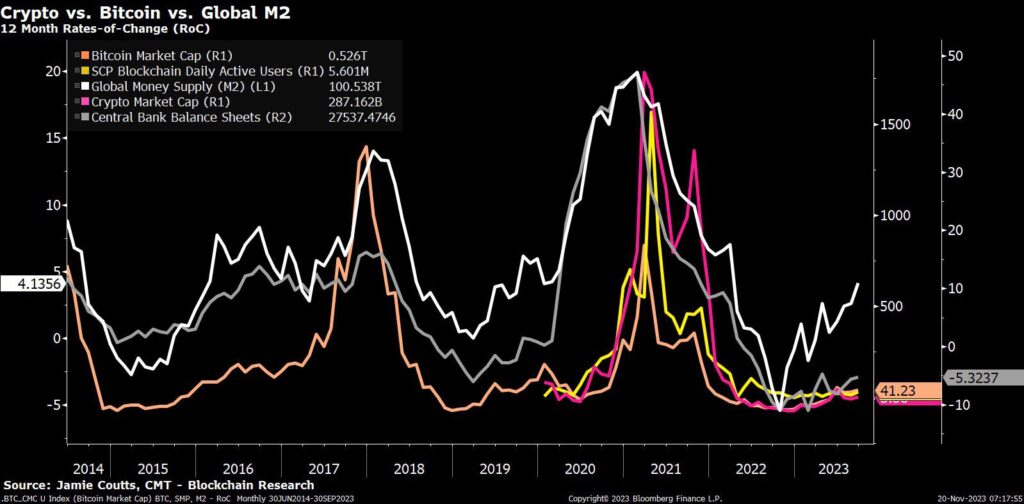

Analyst Jamie Coutts’ chart, published on the Bloomberg platform, reflects how the global money M2 supply reached its turning point at the end of 2022. The late 2022 turning point of the M2 money aggregate correlates with the capitulation and technical turning point of the bitcoin market. Since the beginning of the year, bitcoin has seen a 127 percent upward trend, rising with its market capitalization and central bank balances.

Sources: Jamie Coutts, Bloomberg

Bitcoin’s 2023 performance is in a league of its own compared to stock indices. As a reference, the leading stock index, the S&P 500 has risen 19 percent since the beginning of the year, and the technology-weighted Nasdaq-100 has surged by 47 percent. The year appears to be significantly bearish for the Finnish stocks, with the OMX Helsinki 25 index weakening by -12 percent.

YTD Price Performance:

Bitcoin: +127%

MicroStrategy: +250%

S&P 500: +19%

Nasdaq-100: +47%

OMX Helsinki 25: -12%

The almost zero correlation of the leading cryptocurrency with the stock market makes it an exceptional asset class in these uncertain times. As described in the words of Dan Tapiero, the digital asset market can be characterized as the “only truly free market.” As censorship and the influence of dictatorships increase, this free market becomes invaluable.

“Our space is the only truly free market out there. We have undergone tremendous volatility, massive creative destruction every 2-3 years, and there has been no governmental intervention.” – Dan Tapiero

From a purely technical perspective, bitcoin has encountered three significant technical inflection points over the past year, two of which have been positive and one negative. Just before the transition from 2022 to 2023, bitcoin’s descending and ascending trendlines intersected, signifying both market capitulation and fertile ground for a new upward trend.

Bitcoin experienced a strong rally in the spring but encountered a negative turning point in mid-June. After the summer, BTCUSD reflected selling pressure, which has since transformed into a period of price discovery (turquoise) following September’s technical inflection point. Currently, investors are attempting to price in the future spot ETF and the April 2024 halving.

Sources: Timo Oinonen, CryptoQuant

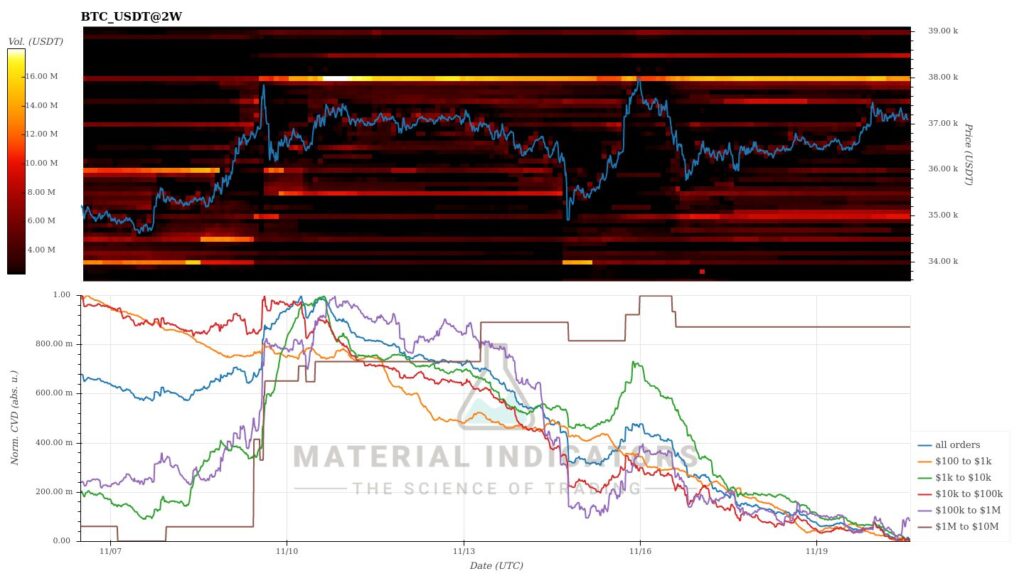

The Material Indicators’ heat map indicates the strengthening of the $35 000 support level. On the other hand, the $38 000 resistance level is also notable, with bitcoin oscillating between these two watershed points. Cumulative Volume Delta (CVD) reveals whales remaining in accumulation mode while demand generated by smaller market participants is decreasing.

Source: Material Indicators

7-Day Price Performance

The escalation of regulatory risk in the form of Binance has stirred cryptocurrencies in the last seven days. As a result of the turbulence, Coinmotion-listed cryptos are unusually diversified, with Uniswap strengthening by almost 12% and Polygon plummeting by -15%. In the big picture, the key focus remains on maintaining bitcoin’s price stability amid the uncertainty.

Bitcoin (BTC): -0,6%

Ethereum (ETH): 1,5%

Litecoin (LTC): -7,1%

Aave (AAVE): -0,6%

Chainlink (LINK): -4,2%

Uniswap (UNI): 11,8%

Stellar (XLM): -2,6%

XRP: -5,1%

Cardano (ADA): 0,5%

Polygon (MATIC): -14,7%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 1,2%

Gold: 1%

YTD Price Performance

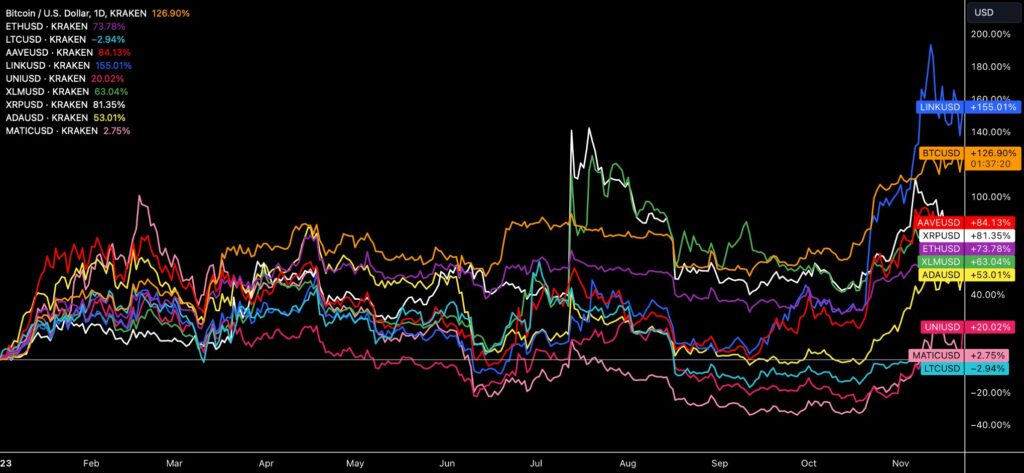

Despite a sharp correction, Chainlink (LINK) maintains its position at the top of Coinmotion’s listings. Having achieved nearly a 200% YTD price growth by early November, the cryptocurrency now boasts a 155% increase since the beginning of the year. The market cap leader, bitcoin, has seen a YTD price growth of 127%, reaching new 2023 highs.

The winter rally from October to November has brought almost all of Coinmotion’s cryptocurrencies into YTD positive territory, with Litecoin being the exception, showing a 2,9% decline. There is a noticeable divergence between bitcoin and Ethereum, with BTC strengthening almost twice as much as ETH since the beginning of the year. Meanwhile, the ETHBTC pair has weakened by -24% this year.

Source: TradingView

150 Days to the Halving

One of the key drivers of Bitcoin’s value, the halving, is now only 150 days away. The halving, also known as halvening, literally halves the block reward distributed to miners, reducing it from 6,25 to 3,125 in April 2024. This event is coded into the cryptocurrency to enhance its inherent scarcity.

Sources: Timo Oinonen, CryptoQuant

An analysis of historical data indicates that the price of bitcoin increased by 1263 percent between the halvings of 2016 and 2020. Furthermore, from the May 2020 halving moment to the subsequent spot price peak, bitcoin strengthened by 654 percent. Assuming bitcoin is trading at a modest $40 000 valuation during the spring 2024 halving, a 654 percent increase would propel bitcoin to over $300 000.

Source: 21metrics

But what is the optimal strategy for trading the halving event? The most classic answer is the buy-and-hold strategy, where an investor accumulates bitcoin when the price is relatively low. Due to the scarcity features of bitcoin, I myself have favored a low-time preference buying program.

Another approach is the tactic recommended by the creator of the stock-to-flow model, PlanB. He has urged investors to employ position trading, where bitcoin purchases are made six months before the halving event. Additionally, PlanB has advised selling the position 18 months after the halving.

How did you plan to approach the #BTC halving event?

— Coinmotion (@Coinmotion) November 25, 2023

There are only 150 days left.

Position trading:

PlanB has urged investors to take advantage of position trading, where bitcoin purchases are made six months before the halving event. In addition, PlanB has advised to sell the…

Binance in the Eye of the Storm Again

Known as the world’s largest digital asset exchange, Binance found itself in a new crisis this week, with its CEO Changpeng Zhao (CZ) admitting guilt to money laundering. The Wall Street Journal (WSJ) suggests that this admission may pave the way for the exchange to continue its operations in the future.

The controversial Binance has been accused of guiding its U.S. customers to conceal their locations, allowing the platform to circumvent strict U.S. anti-money laundering laws. The platform was supposed to implement a so-called geofencing, which categorizes customers geographically. The U.S. government has escalated the situation by accusing the exchange of facilitating funding for ISIS, Al-Qaeda, and Hamas organizations.

CZ will be allowed to live in the UAE while he awaits sentencing. It was a “very close call” as to whether he would be allowed to go back to the UAE. CZ had to speak himself to convince the court. CZ must return to the USA 14 days prior to his sentencing. The transcript extract…

— BitMEX Research (@BitMEXResearch) November 21, 2023

Binance has agreed to a total of $4,3 billion in fines. Simultaneously, Zhao is stepping down from his position as the CEO of the exchange and faces personal fines of $50 million, although the final amount may still change. Between Wednesday and Thursday, almost a billion dollars worth of funds flowed out of Binance.

According to BitMEX Research, Changpeng Zhao is allowed to stay in the United Arab Emirates (UAE) before the actual trial, even though there is no formal extradition treaty between the UAE and the United States. Zhao is required to return to the United States 14 days before the trial.

Sources: Timo Oinonen, CryptoQuant

The issues facing Binance are also reflected in its native exchange token, BNB, which has weakened by around seven percent in the past week. BNB continues to hover above its multi-year support level (orange), showing a three percent decline since the beginning of the year. Although BNB managed to break free from its descending technical wedge (white), a drop below the key support level would be a dramatic scenario.

In the context of the entire industry, the weakening of Binance’s dominance may not necessarily be a negative phenomenon. Our previous reports have criticized the exchange’s market share, which surpassed 90 percent in the spot market earlier this year. Binance has been a potential single point of failure for the industry, simultaneously forming an attack vector for hostile actors. Moreover, the dominance of a single company is at odds with our industry’s principles and ethos of freedom and decentralization.

COIN Stock Surges Nearly 200% Year-to-Date

The challenges faced by Binance can be seen as leading to a “wealth redistribution,” where the U.S. competitor Coinbase is improving its position. The increase in Coinbase’s volume is reflected in the rise of its premium, while Binance’s billion-dollar outflows are seeking new homes. The listed Coinbase’s COIN stock has risen by 190 percent since the beginning of the year, climbing close to MicroStrategy’s (MSTR) levels. Both COIN and MSTR stocks act as leading indicators for bitcoin.

Source: Google Finance

What Are We Following Right Now?

Argentinian libertarian presidential candidate and economist Javier Milei has won his country’s elections. Milei has gained prominence as a Bitcoin supporter and a challenger to the prevailing political status quo. Additionally, he has criticized the country’s failed central bank policies. Both El Salvador and Argentina now have state leaders who are supportive of Bitcoin.

#Bitcoin jumps as #Argentina's Pro-Bitcoin candidate Javier Milei won election. pic.twitter.com/T20IXuWRxg

— Holger Zschaepitz (@Schuldensuehner) November 19, 2023

Is the U.S. stock market being manipulated? Preston Pysh predicts the Fed will continue strong stimulus next year.

Raoul Pal and Dan Tapiero explore digital assets. Why are cryptos the “world’s only truly free market”?

Stay in the loop of the latest crypto events

- Bittrex Global shutdown — how to move funds from Bittrex to Coinmotion

- Interest in Bitcoin ETFs persists in rising — Bitcoin value climbs 28% in October

- Are We Approaching a Selective Altseason?

- Polygon (MATIC) – Infrastructure for billion users

- A 100 000 Dollar Target Price: The Bold Prediction and its Basis

- Report your crypto investments to Verohallinto: Lesson #11

- A Prologue to the Upcoming ETF Market Reaction

- Dive into Cardano (ADA): A newcomer’s comprehensive guide

- Security measures to safeguard your cryptocurrencies: Lesson #10

- 200 Days Until the Halving: Bitcoin’s Next Chapter

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.