The technical analysis of week 1 breaks down into the nascent optimism and market correlations. In addition, we familiarize ourselves with Chaikin Money Flow and MVRV indicators, as well as the operations of the central bank Fed.

The Technical Setting Offers Optimism

The crypto market has seen a nascent rise in spot prices this week, with leading cryptocurrency bitcoin rising 3,3 percent. At the same time, the ether token of the leading DeFi platform has risen by more than nine percent in a one-week window. Well-known analyst and trader Gareth Soloway sees the market base of bitcoin still lower, but according to him, bitcoin will return to parabolic price development in 2024 at the latest.

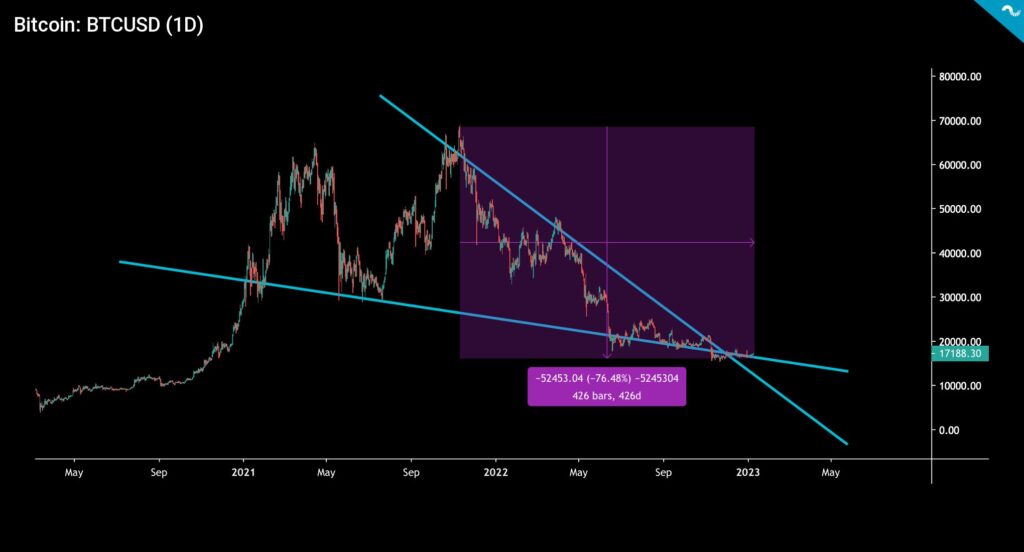

Bitcoin is still in a multi-year downtrend, the starting point of which extends to November 2021. During the 426 days from the end of 2021 to the beginning of 2023, the spot price of bitcoin (purple) has weakened by -76,48 percent. Technically, the price is at the intersection of two descending trendlines (turquoise), which form the setup for an upward correction. Bitcoin has had a tendency to find its market base 517-547 days before the halving event, and the 2024 halving is already less than 500 days away.

The strengthening of the crypto market at the beginning of the week has mainly been supported by the buying pressure that appeared during the Asian trading hours. Although digital asset exchanges are open 24 hours a day, the vast majority of trading occurs during the daytime on each continent. The buying pressure from Asia is also supported by the fact that the local exposure to FTX has been less than elsewhere. Asian investors especially prefer the Binance and OKX platforms.

The crypto market has gathered clear momentum compared to last week. With Ethereum strengthening by almost 10 percent, the loan platform Aave has risen by a commendable 15 percent. Litecoin, approaching its halving event, has strengthened by 7 percent in a week and almost 15 percent within two weeks. Both the leading stock index and gold have risen moderately since last week.

7-Day Price Performance

Ethereum (ETH): 9,2%

Chainlink (LINK): 7,1%

Stellar (XLM): 6,4%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 1,8%

Gold: 1,8 %

The Correlation Between Bitcoin and S&P 500 in Decline

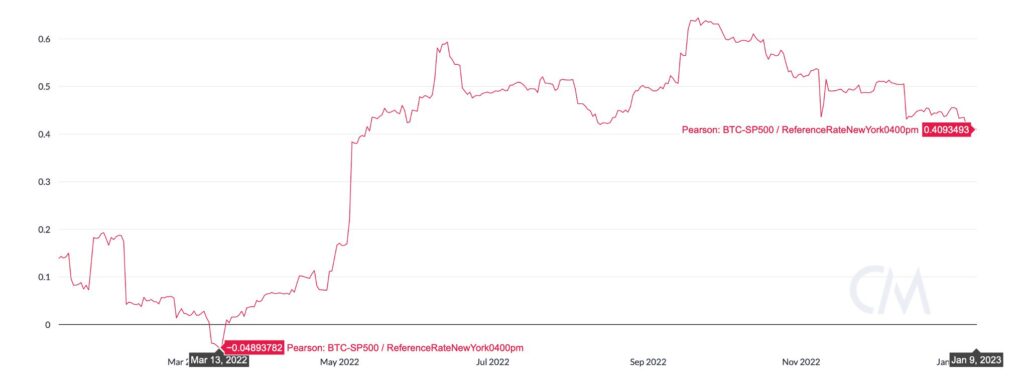

The correlation between bitcoin and the stock market index S&P 500 is still downward, which may lead to a broader decoupling phenomenon. The 90-day Pearson correlation has already fallen to 0,41 after hitting an all-time high of 0,64 in mid-September. The correlation between bitcoin and the S&P 500 has been in a huge paradigm shift this year, hitting a low of negative -0,05 in mid-March. For years, bitcoin had a weak correlation with the stock market, but the situation changed in the “Saylor cycle” of 2020 when the correlation increased significantly.

The essential question is, do we want bitcoin to break away from the stock market correlation? Several big-name analysts are now waiting for the Fed’s pivot move, which would undoubtedly bring new momentum to the stock market. As the stock market strengthens, the correlation to bitcoin will likely remain strong, although a sovereign breakout of high-beta assets is always a possible scenario. Stock market correlation can be seen as protecting bitcoin yet providing an option to exit in bullish cycles.

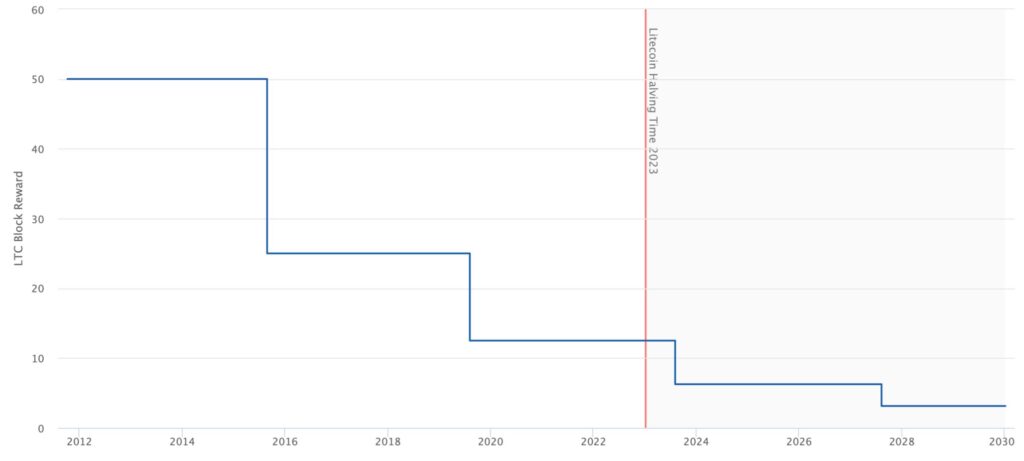

Litecoin Approaches its Halving Event

The halving event of the popular cryptocurrency litecoin, also known as bitcoin’s “testnet”, is approaching. At the time of writing, there are only a bit over 200 days until the halving scheduled for the third day of August. The event drops the litecoin block reward from 12,5 to 6,25. Despite the bear cycle of 2022, litecoin managed to increase the number of new addresses in the network to 52 million last year. In addition, the network handled more than 39 million transactions in 2022.

Litecoin’s supply is limited to 84 million native units (LTC), its characteristics making the cryptocurrency scarce and even deflationary. The fundamental purpose of the halving event is to preserve the purchasing power of the tokens, and there have been two halvings so far, in 2015 and 2019. The previous halving events resulted in a significant LTC price rally.

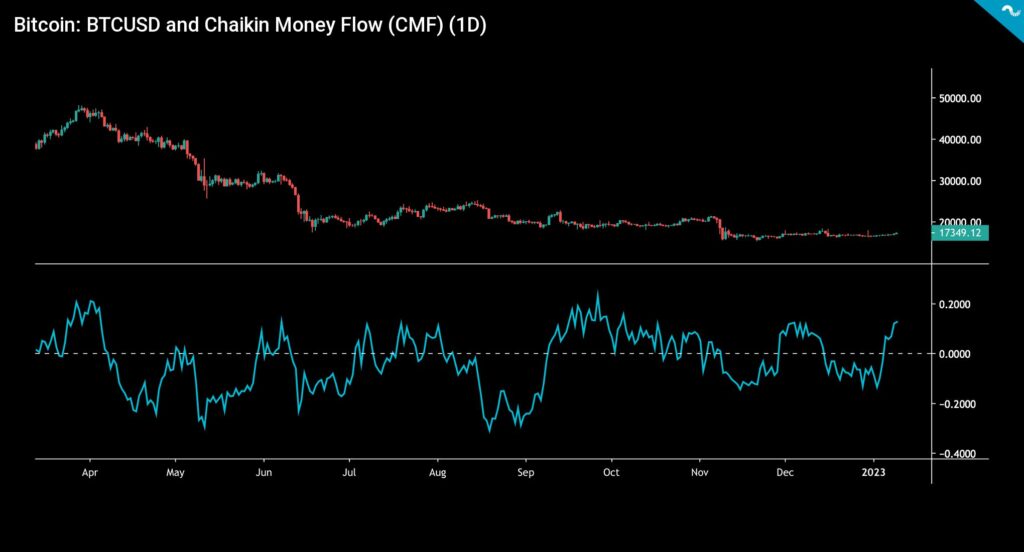

Chaikin Money Flow Indicates Nascent Market Strength

Although the spot price of bitcoin is up 4,4 percent since the beginning of the year, in the larger time window, it has weakened 76% from its November 2021 peak. Bitcoin, like many technology stocks, is oversold, as illustrated by Chaikin Money Flow indicator. The simplest way to interpret the Chaikin Money Flow is to divide the CMF data into values above and below zero. CMF values above zero (> 0) indicate market strength, and values below zero (< 0) indicate relative weakness.

After falling into the negative sector twice during the fourth quarter of last year, CMF has again found a new growth angle. On the second day of January, the CMF was still at a negative level, falling to -0,13. However, the next weekend, the CMF reached a positive reading of 0,12. If the current positive CMF trend continues, it will be transmitted to the spot price as positive momentum.

In summary, Chaikin Money Flow reflects that bitcoin is in a heavily oversold market not seen since 2015.

The Fed Is Expected to Raise Rates by 25 Basis Points

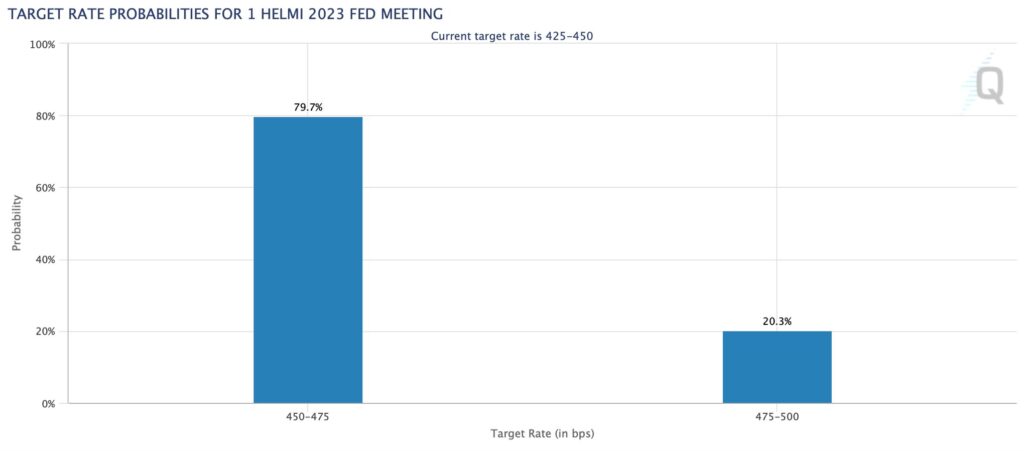

The Fed’s FOMC meeting is approaching again, and at the time of writing, it is 21 days away. Many analysts have predicted that the Fed will slow its pace of rate hikes and even reverse its monetary policy direction. The Fed’s rhetoric was very hawkish last year when the central bank justified the necessity of interest rate hikes from the point of view of inflation control. Despite this, analyst Luke Gromen has said that the stimulus line (QE) will return sooner or later. CME data predicts that the FOMC meeting at the beginning of February will end with a rate hike of only 25 basis points, which would be a remarkably light solution after last year’s 75 one-time hikes.

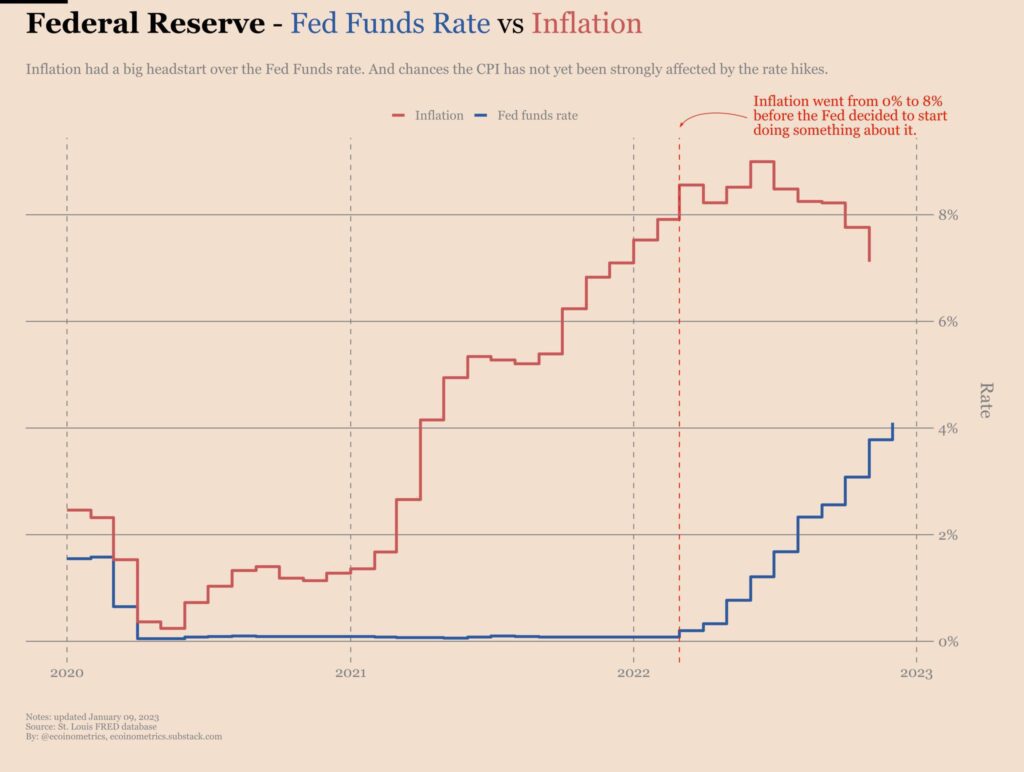

However, the interest rate hike line (blue) may in fact be approaching its endpoint because, according to the graph on the Ecoinometrics, inflation (red) has clearly turned down. Ecoinometrics reminds us that the Fed expected inflation to rise from zero to eight percent before the central bank took actual action. As late as 2021, the Fed gave out “inflation is transitory” statements, which were wrong interpretations. Since then, the Fed has engaged in historically steep interest rate hikes to counter skyrocketing inflation.

MVRV Indicates Bitcoin Still Being Undervalued

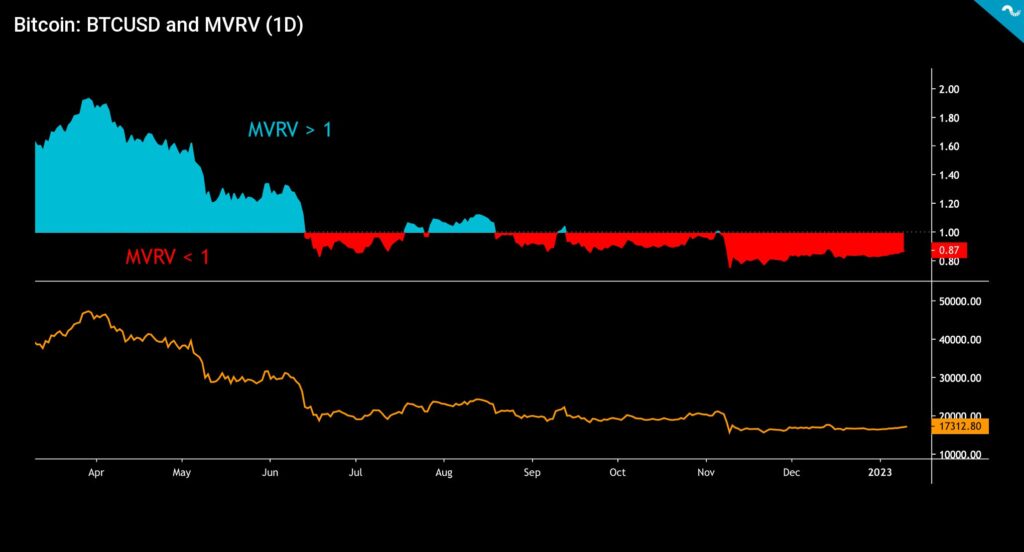

Bitcoin’s market value to realized value indicator (MVRV) is currently at 0,87, indicating that bitcoin is clearly undervalued. Valuation levels below one are rare for the MVRV indicator and last occurred in November 2011, January 2015, December 2018 and March 2020. In summary, the current MVRV indicates that bitcoin is in a deep accumulation zone.

The MVRV indicator is calculated by dividing the market value of bitcoin by the realized value and was developed by David Puell and Murad Mahmudov in 2018. The Puell Multiple, which was involved in technical analyses, is also named after David Puell. Bitcoin is considered overvalued when MVRV exceeds 3,7. Accordingly, MVRV indicates an undervaluation of bitcoin when MVRV falls below 1.

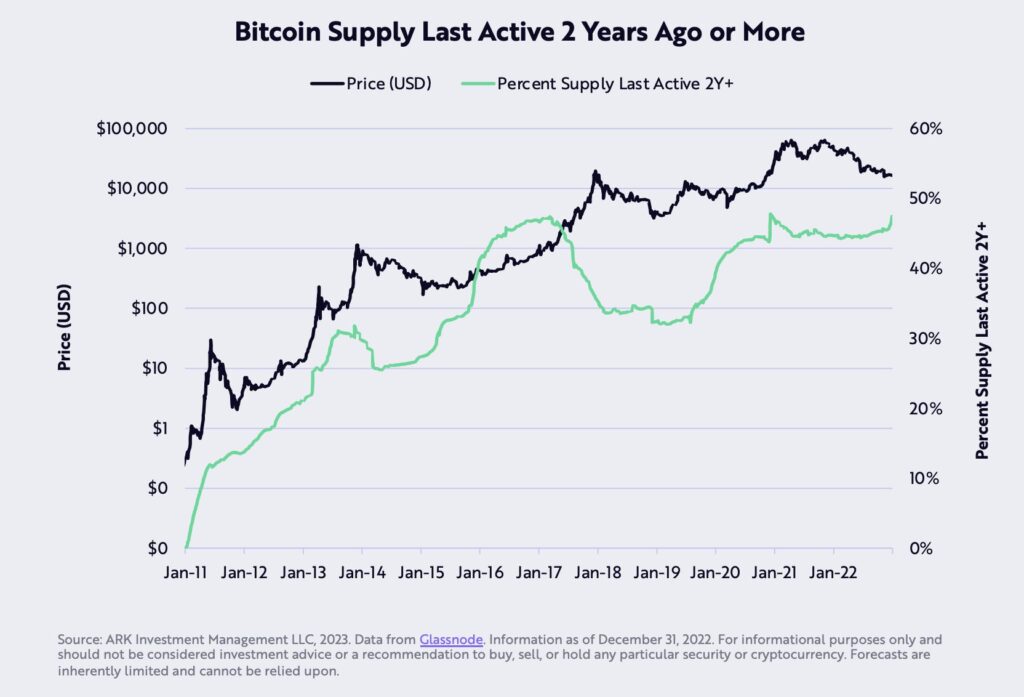

According to a recent chart by ARK Invest, almost 50 percent of the bitcoin supply has not moved in the past two years. The phenomenon can be interpreted as a strong holder behavior with a long time horizon. The last time bitcoin’s supply activity was this low was in 2017, resulting in a parabolic development cycle of the spot price.

What Are We Following Right Now?

Gareth Soloway and David Lin discuss the outlook for bitcoin, gold and the stock market in 2023.

Valkyrie Investments’ Steven McClurg opens up his views on the DCG Group crisis and the Grayscale fund. McClurg also talks about the overleveraged market and bitcoin’s potential bottoming out.

The Great Bitcoin Debate, in which Lyn Alden and George Selgin present their opposing positions on the asset class.

Stay in the loop of the latest crypto events

- NFT market value increased by 11,000 percent in 2020-2022

- Technical Analysis: Michael Saylor in Accumulation Mode Again

- Crypto exchanges’ reserves & PayPal and MetaMask cooperation

- Bitcoin’s Price Predictions for 2023

- The crypto scam landscape: What to look out for?

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.