The Technical analysis of week 40 explores bitcoin’s bearish technical signals, including Bollinger bands, price compression, confluence zone, and upper resistance. Additionally, we analyze BitMEX’s “omega wick” and how bitcoin eclipsed most asset classes in the third quarter of 2022.

Bitcoin Tries to Keep its $19K Support

The leading cryptocurrency, bitcoin, still tries to hold on to the $19K level, inching closer to the support. Bitcoin’s spot price was compressed by Bollinger bands (purple) last week, however, now the Bollinger bands seem to expand. With the majority of the retail-induced selling pressure gone, bitcoin trades sideways alongside the multi-year confluence and support zone.

Bitcoin’s spot price has been supported by the ascending support line (green); however, the line has recently been stress tested. Bitcoin’s relative strength index RSI (blue) is also in a sideways motion, mirroring the stagnant sentiment.

The current market is challenging for short-term traders as the price action mainly moves sideways. The market is exceptionally choppy compared to summer’s moderate bull cycle from June’s $19K lows to mid-August $24K highs. The summer relief rally was a perfect opportunity for swing traders.

The longer time horizon shows how bitcoin has been trying to cross the upper resistance (turquoise) five times since early June, but the attempts have been rejected. The green support line is now about to meet the upper resistance, resulting in a decisive technical aperture.

The cryptocurrency market has weakened across the board within the last seven days, with bitcoin and ethereum both dropping close to -3 percent. Smaller-cap tokens, like Uniswap, have weakened almost three times as much as the leading cryptocurrency, as they’re known to be higher beta assets. XRP is countering the market with a 5,8 percent climb from last week. The ongoing dispute between SEC and Ripple Labs seems to strengthen the market sentiment and whale activity. The leading stock market index S&P 500, has weakened by -5,33 percent within the past seven days, which is significantly more than bitcoin. Additionally, gold has dropped -3,3%, suffering more than bitcoin and ethereum.

Bitcoin (BTC): -2,9%

Ethereum (ETH): -3,2%

Litecoin (LTC): -4,1%

Aave (AAVE): -5,2%

Chainlink (LINK): -2,5%

Uniswap (UNI): -9,5%

Stellar (XLM): -0,4%

XRP: 5,8%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: -5,33%

Gold: -3,3%

– – – – – – – – – –

Bitcoin RSI: 45

Bitcoin Still Below The Realized Price

The markets were scared on Tuesday by BitMEX’s perpetual inverse swap contract dropping to a level of 8300 US dollars. The “omega wick” of the perpetual inverse swap contract only mirrors the futures market. However, the flash crash can also be interpreted as a bad omen. While some traders believe that these flash crash gaps need to be filled, that is not a factual certainty.

Update: BitMEX later confirmed that the “omega wick” was a visual bug.

Bitcoin’s spot price (white) has now fallen approximately 2000 dollars below the realized price (blue), as the spot is at $19K and RP at $21K. During the summer 2022 relief rally, the spot price was able to rise above the realized price, but unfortunately, the tables have turned again. Some analysts expect bitcoin to be dropping lower toward its delta price, which would mean a price level of $17 000.

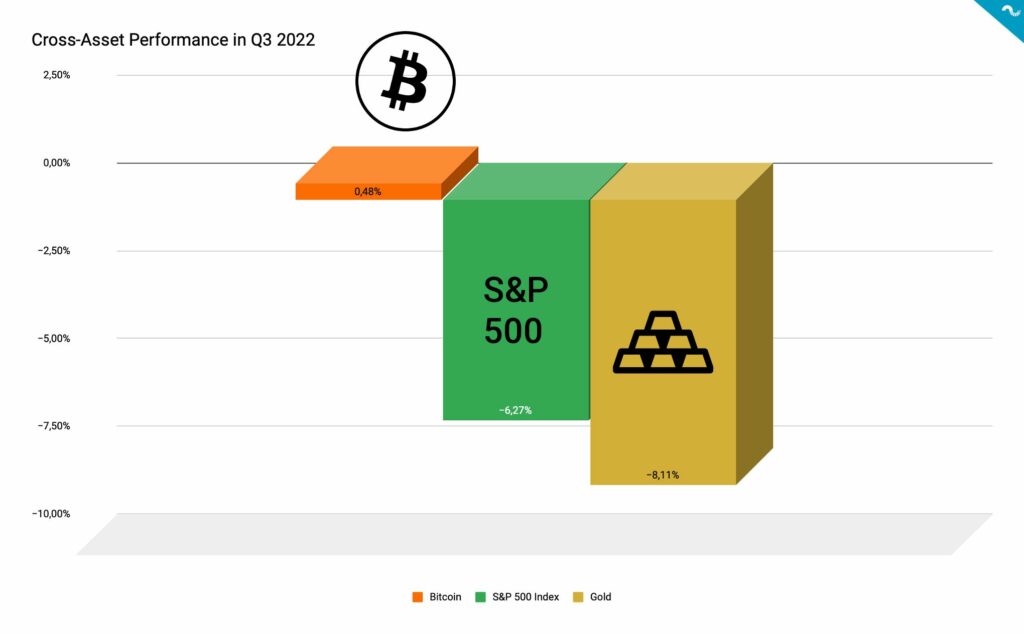

Bitcoin Leads Cross-Asset Performance in Q3 2022

Despite the bearish short-term technicals, Bitcoin has been resilient as an asset class during the third quarter (Q3) of 2022. In Q3, Bitcoin’s spot price (orange) increased 0,48 percent, while the main stock market index S&P 500 (green) weakened -6,27%. Gold (yellow) dropped even more, sliding -8,11 percent during the third quarter. Bitcoin seems almost antifragile when benchmarked against these asset classes.

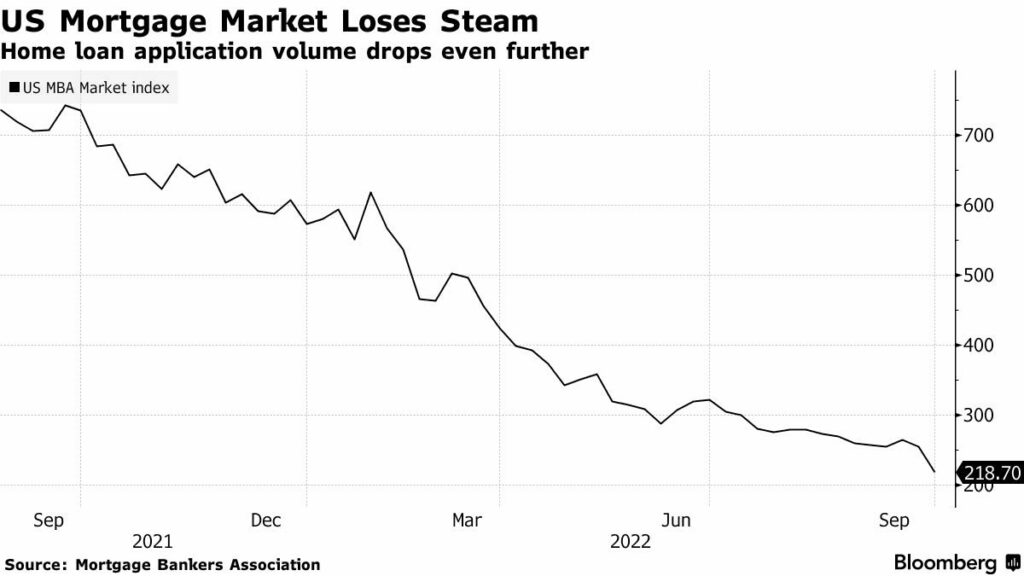

As a high-beta asset, Bitcoin was the first to be sold in the early 2022 market correction. However, that also means Bitcoin is the first one to reach its market base. As the risk profile rises in traditional markets, stocks and gold will face escalating downward pressure. The housing market is expected to be approaching a correction next, and as the largest global asset class, its challenges will be mirrored in the stock market.

The housing market is currently facing a confluence of red flags. Home buyer sentiment is at historic lows, mortgage rates have increased 2,5 times, and house affordability is at the 2006 level. Additionally, property prices have fallen a lot.

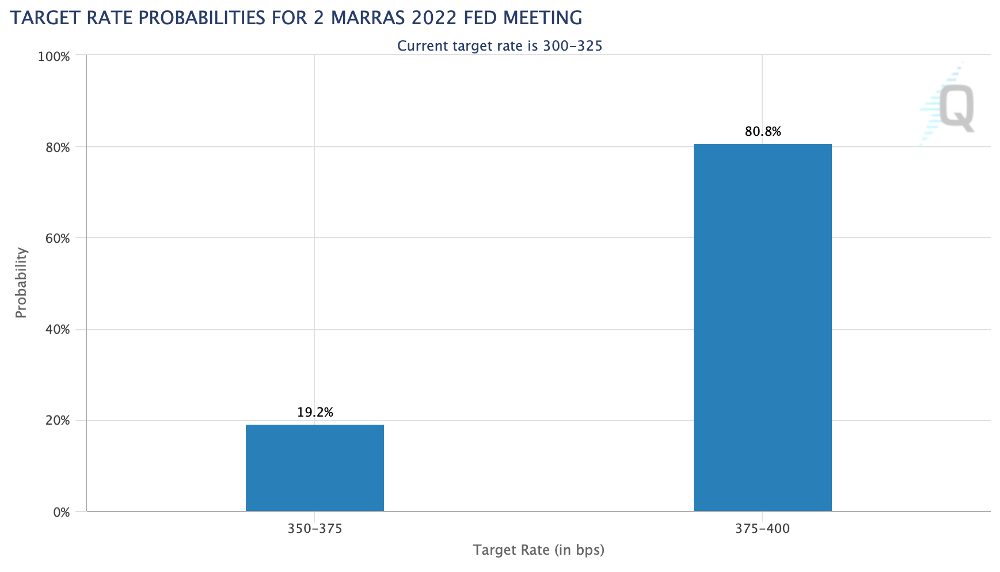

All Eyes on November’s FOMC Meeting

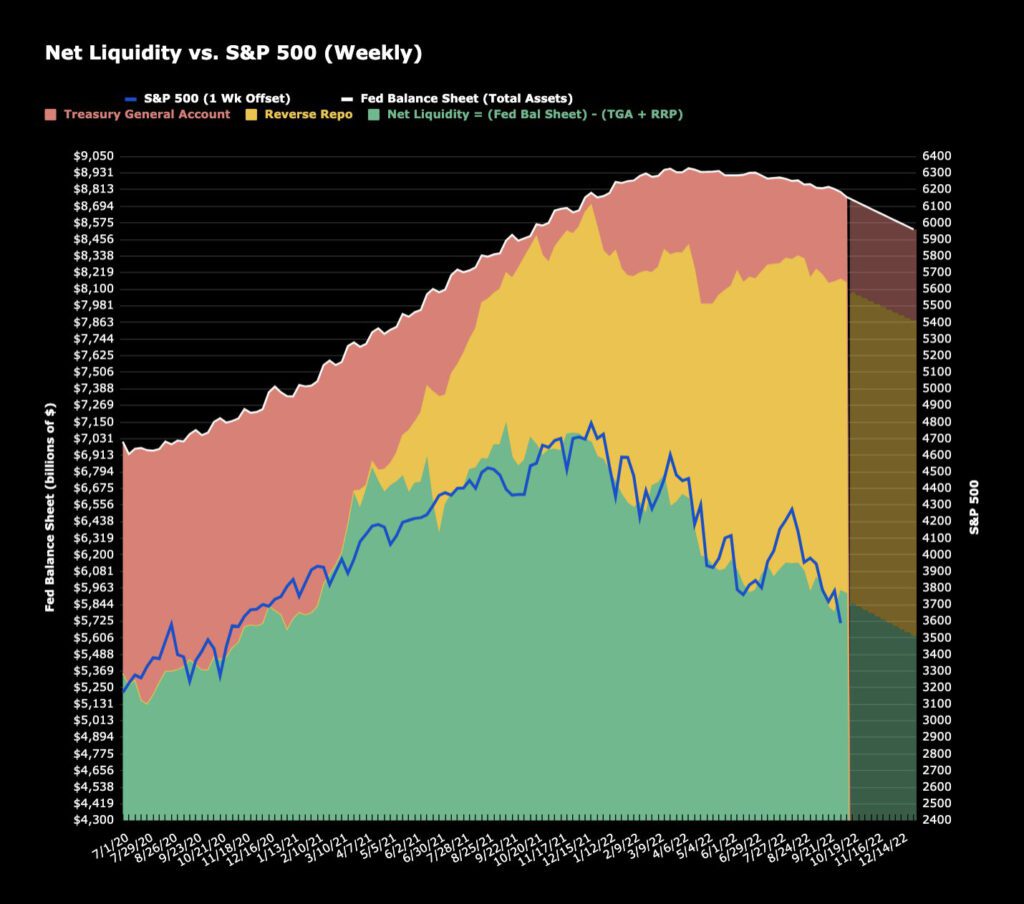

The Federal Reserve (Fed) has been implementing exceptionally hawkish monetary policies this year, heavily stirring the markets. Many market participants were already used to the zero interest rate cycle, and now the rapidly tightening dollar supply might create a liquidity crisis. Earlier this week, Cathie Wood wrote an open letter to the Fed in which she suggests that the central bank “has shocked not just the US but the world and raised the risks of a deflationary bust.”

Despite all the mayhem, Fed’s Jerome Powell doesn’t seem to show much mercy, and CME’s data shows how investors expect the central bank to raise rates yet again by 75 basis points in November. The 75 bps hike would be another cold shower for the markets, even though the noble cause is to control inflation.

As mentioned before, the S&P 500 index has weakened significantly more than bitcoin, and end-of-year targets indicate 3000+ levels. Although the lower levels are likely to be used for short covering, the hawkish Fed could still bring much pain to the S&P.

What Are We Following Right Now?

The British pension funds were saved by the Bank of England (BoE) in early October, as they were quickly approaching a margin call situation. The troubles seem to be mounting in the background again, as UK’s Gild bonds are down -52,3 percent since December 2021. BoE will likely need to continue its “transitory” quantitative easing program.

Long-term UK Gilt bonds have posted a total return of -52.3% since Dec 2021. An entire decade of gains wiped out. pic.twitter.com/FW8LI62dsh

— Liz Young (@LizYoungStrat) October 11, 2022

Google is now providing data on Ethereum addresses via its search engine. The world’s biggest website now tells you how much ETH some wallets hold when you add an Ethereum address to the search box.

Crypto addresses are now searchable on Google pic.twitter.com/tJjor0j4Rk

— Blockworks (@Blockworks_) October 11, 2022

Portugal is planning to start taxing digital asset gains on purchases held for less than a year. The proposed 2023 budget would tax gains on crypto holdings held for less than one year at a rate of 28%.

Portugal is planning to start taxing digital-currency gains on purchases held for less than a year in a major policy shift for one of Europe’s most crypto-friendly nations https://t.co/z1Z4kNDxsH

— Bloomberg (@business) October 10, 2022

Gain knowledge and read insights from our previous TA’s

Bitcoin Holds The $19K Confluence Level, Reaches Towards Bear Rally

Is Bitcoin Decoupling from The Stock Market?

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!