The technical analysis of week 45 focuses on FTX’s unfortunate meltdown saga and its multiplicative effects. Additionally, we take a deep dive into technical indicators, exchange stats, and blockchain data.

Markets Still Shocked by The FTX Meltdown

The markets are still in a “panic state” after the meltdown of FTX, formerly the second-largest exchange globally. Last week FTX filed for chapter 11 bankruptcy protection, which offers the company cover against an estimated selection of 1 million debtors. FTX also has over 130 related companies that are likely to face the same fate as their mothership. While chapter 11 does not equal to bankruptcy, FTX’s liquidity crisis is severe, and the exchange is said to have a $10 billion hole in its balance sheet. Despite all the market mayhem, Michael Saylor still stated his positive ethos towards the Bitcoin asset class:

“The FTX collapse is an expensive ad for Bitcoin. Too many good ideas have been pursued by the crypto industry in an unethical, unsound, and irresponsible fashion. The only viable future is registered digital assets trading on regulated digital exchanges.”

– Michael Saylor

Bitcoin has fallen through the critical $19K multi-year confluence and support level towards $16-17K. The current support is at $15K; however, bitcoin bottoming to $10K remains a possibility. Bitcoin’s SOPR indicator (Spent Output Profit Ratio) is still at 0,99, and it needs to drop to 0,92 in order to signal eventual capitulation.

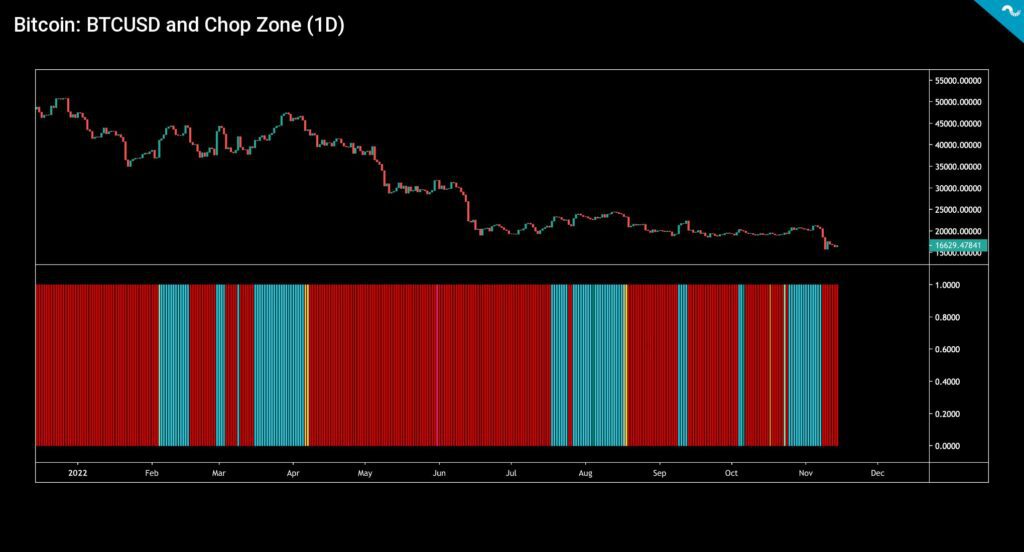

Bitcoin’s chop zone indicator shows a strong positive trend in late October, and early November before the FTX meltdown initiated. Regarding the bullish seasonality of November, rising S&P 500 & Nasdaq 100 indices, and lower CPI, bitcoin’s fair price would be in the $25-30K range sans the FTX case.

The leading cryptocurrency, Bitcoin, continued its decline, sliding -8,8 percent after last weeks -9,6%. Ethereum’s drop was more moderate this week, declining -5,1% after the previous week’s -15,7%. DeFi-related tokens like Aave and Chainlink continued to weaken in double digits. In contrast to digital assets, S&P 500 was able to rise 4,27%, which is a significant percentage. Gold had an excellent week as well, rising 5,6%.

7-Day Price Performance

Bitcoin (BTC): -8,8%

Ethereum (ETH): -5,1%

Litecoin (LTC): 3,1%

Aave (AAVE): -14,2%

Chainlink (LINK): -15,3%

Uniswap (UNI): 5,8%

Stellar (XLM): -6,5%

XRP: -5,3%

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!

S&P 500 Index: 4,27%

Gold: 5,6%

Divergent Exchange Behaviour

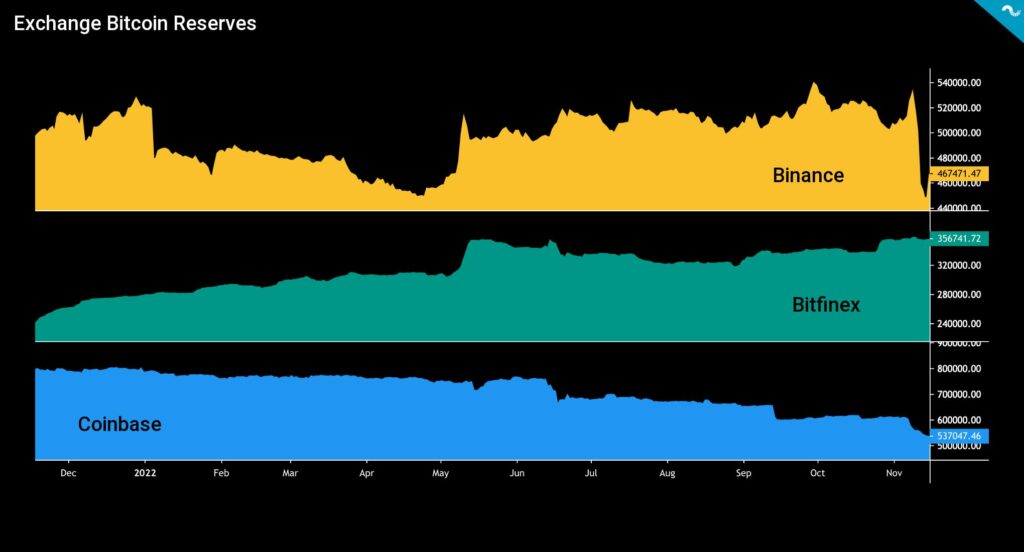

The exchange response to the FTX crisis has been divergent. Binance’s native bitcoin unit reserves have declined -15 percent from 53 000 to 45 000 units; meanwhile, the exchange bitcoin reserves of Bitfinex continued to climb through 35 000 units. Coinbase’s bitcoin reserves are still in a secular downtrend, dropping -23% from early 2022.

Blockchain analytics platform Nansen’s data recently shows more ETH and ERC-20 token deposits than withdrawals. $318 million worth of tokens were added to the Bitfinex exchange alone, and $217M worth to Binance. Seems that Bitfinex is strengthening its position in the exchange rivalry.

A Spreading Contagion?

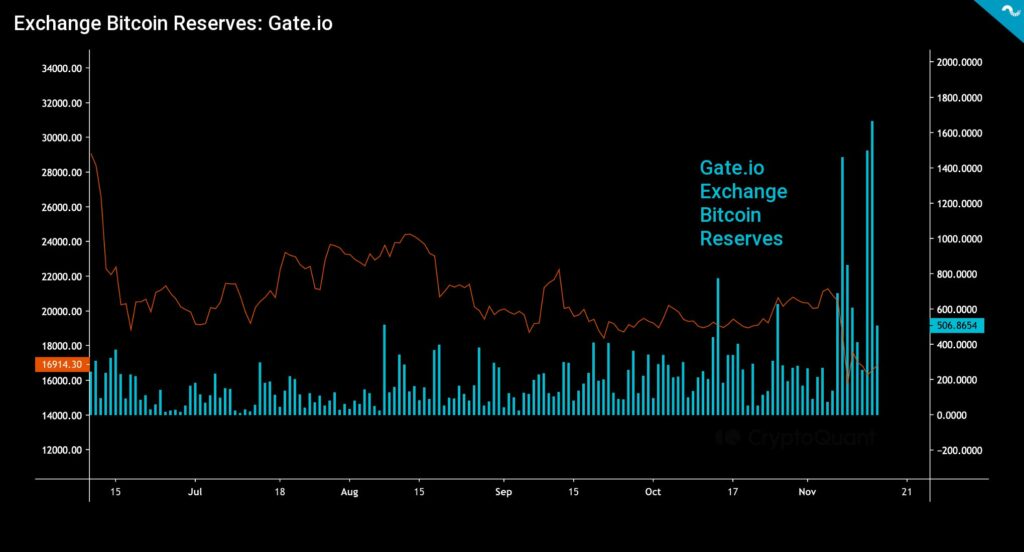

The markets were spooked on Sunday (13.11), as 320 000 ether units were transferred from Crypto.com exchange into Gate.io. The dollar value of the transaction was 405 million USD. Especially Gate.io’s liquidity has been under suspicion, and the exchange has seen an escalating amount of outflowing bitcoin reserves (chart below). On November 14th alone, 1700 bitcoin units outflowed from Gate.io, effectively signaling a bank run situation.

The liquidity of the crypto market has been under scrutiny following the meltdown of FTX and Alameda Research. The latter was one of the largest market makers in crypto, providing billions of dollars worth of liquidity for high-cap and low-cap tokens. Alameda’s entire trading operation was de facto supported by FTX and the misuse of client funds. Last Thursday, Alameda Research announced they would officially wind down trading. Crypto liquidity is dominated by just a handful of trading firms, including Wintermute, Amber Group, B2C2, Genesis, Cumberland, and (the now defunct) Alameda. With the loss of one of the largest market makers, we can expect a significant drop in liquidity. Of the previously mentioned trading firms, Amber Group, Wintermute, and Genesis have announced lost funds in the FTX.

Since November 5th, the day that CoinDesk published its investigation of Alameda’s balance sheet, bitcoin’s liquidity within 2% of the mid-price has fallen from 11 800 BTC to just 7000, its lowest level since early June. The chart below mirrors the market depth across 18 exchanges, including FTX, which no longer has any real market-making activity. Even when excluding FTX from the chart, there is still a huge drop in depth, which suggests market-wide liquidity was significantly impacted by Alameda’s collapse and losses incurred by other market makers. Since November 5th, Kraken’s BTC depth has fallen by 57%, Bitstamp’s by 32%, Binance’s by 25%, and Coinbase’s by 18%.

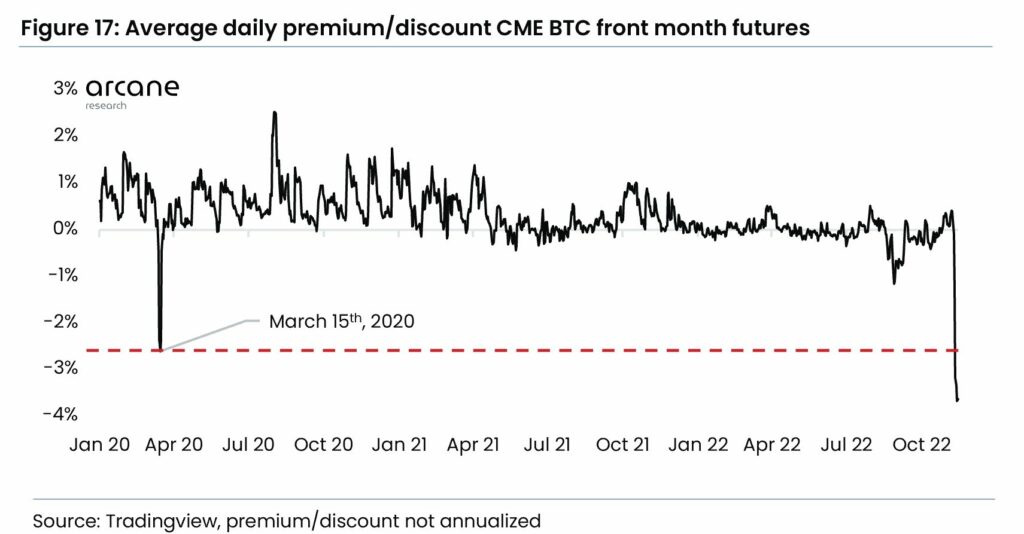

Institutional Shorts

CME Bitcoin futures are known to be popular among hedge funds, and the 2018’s market crash has been mentioned as stemming from institutional-level shorting. Now we’re again seeing growing interest from institutions, however, unfortunately, they’re shorting BTC heavily. The recent data shows massively growing open interest (OI) and futures term structure backwardation.

Grayscale GBTC’s Discount Reaches Record Lows

Launched back in 2013, Grayscale is one of the iconic institutional bitcoin companies in the industry. Grayscale is known for its crypto-related funds, including GBTC, ETHE, and others. Grayscale was long the only practical way for traditional money to invest in digital assets, and it used its monopoly position to charge notable fees (2%). Recently, Grayscale has been facing increasing competition from new ETFs, first in Canada and also in the United States. Grayscale plans to convert GBTC into a spot ETF as soon as possible.

One of the most interesting features of GBTC was its premium over bitcoin’s price, peaking at +132,6 percent in late May 2017. Premium, or discount to net asset value (NAV), refers to the difference between the nominal value of the trust holdings versus the market price of the holdings. Since 2021, the premium has been on a downward trajectory, descending from early 2021 29 percent to the current -39,79%. The dropping premium (or discount) was a leading indicator of bitcoin’s price during previous years.

Grayscale’s attempts to convert GBTC into an ETF form have been rejected by SEC so far. However, the company has filed a lawsuit against the SEC, calling the spot ETF rejection “arbitrary, capricious, and discriminatory.” Later the American Blockchain Association showed major support for Grayscale. Some investors now believe that Grayscale would have credible chances of success in its lawsuit and spot ETF application. GBTC’s investment thesis is that a speculative investor could buy the shares with a -39,79 percent price cut and profit later by the ETF listing. Obviously, this blue-sky scenario assumes the spot ETF will be approved in the foreseeable future.

This week, dubious clouds are seemingly gathering over the GBTC’s group member Genesis, as the crypto broker is no longer an authorized participant for the fund since Oct 3rd. However, Genesis still continues to act as a liquidity provider for the GBTC. Genesis is hosting a client call on Wednesday, implying upcoming major changes.

Korea Premium on Highest Levels since May

In the eye of the FTX-induced market crash, a wide divergence seems to be forming between North American and Asian markets. While the Coinbase index has been declining, the Korean (Kimchi) premium is at its highest level since May. It signals that Korean retail clients still have an appetite for buying the dip.

What Are We Following Right Now?

Dylan LeClair explains how the FTX exploiter, who has been dumping all other drained assets for ETH, is now one of the largest ether holders in the world. The exploiter now has 228 523 ether tokens in their wallet.

The FTX exploiter, who has been dumping all other drained assets for ETH, is now one of the largest holders in the world, with 228,523 ETH ($284.82m) currently in their wallet.

— Dylan LeClair 🟠 (@DylanLeClair_) November 15, 2022

Everyone should keep an extremely close eye on what happens next… pic.twitter.com/SAP3UkyVaa

As many traders already knew, Alameda Research used to front-run clients on the FTX platform. Despite the obvious market advantage, they managed to lose an incredible amount of money.

5/ In the early days, Alameda being a heavy portion of @FTX_Official's volumes was an open secret.

— Jason Choi (@mrjasonchoi) November 15, 2022

Employees told me Alameda has an exclusive API key that allows faster access than any user – offering a systematic way to profit off clients.

A message I sent to a FTX investor: pic.twitter.com/VdM2b5HmDe

The decentralized exchange Uniswap is gaining a lot of new users, making a new record for 2022.

New users of Uniswap’s Web App reached a 2022 high.

— Uniswap Labs 🦄 (@Uniswap) November 14, 2022

Self-custody and transparency are in demand and users are flocking to what they know and trust.

Let’s keep building. pic.twitter.com/IwPqTmx58J

Ran Neuner, founder and host of Crypto Banter discusses the recent FTX collapse and its implications with Michelle Makori. Ran highlights the effects of the FTX bankruptcy on other markets and what effect this will have on cryptocurrencies in the short and medium terms.

On The Margin wraps up the events leading up to the bankruptcy of FTX and explains how the markets evolved throughout the week.

Learn from our previous TA’s

- Technical Analysis: A Speculative Attack on FTX Exchange

- Technical Analysis: Is Altseason a Possibility?

- Technical Analysis: Bitcoin Approaches a New Pool of Liquidity at $20K

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.

Get started with Bitcoin Litecoin Ethereum AAVE USDC Stellar Ripple

Join Coinmotion and buy your first cryptocurrencies within minutes!