Technical analysis for week 27 looks at the decreasing volatility of bitcoin and contrasting high volatility of small-cap digital assets.

Bitcoin’s Volatility Decreases While Small-Cap Tokens Remain Volatile

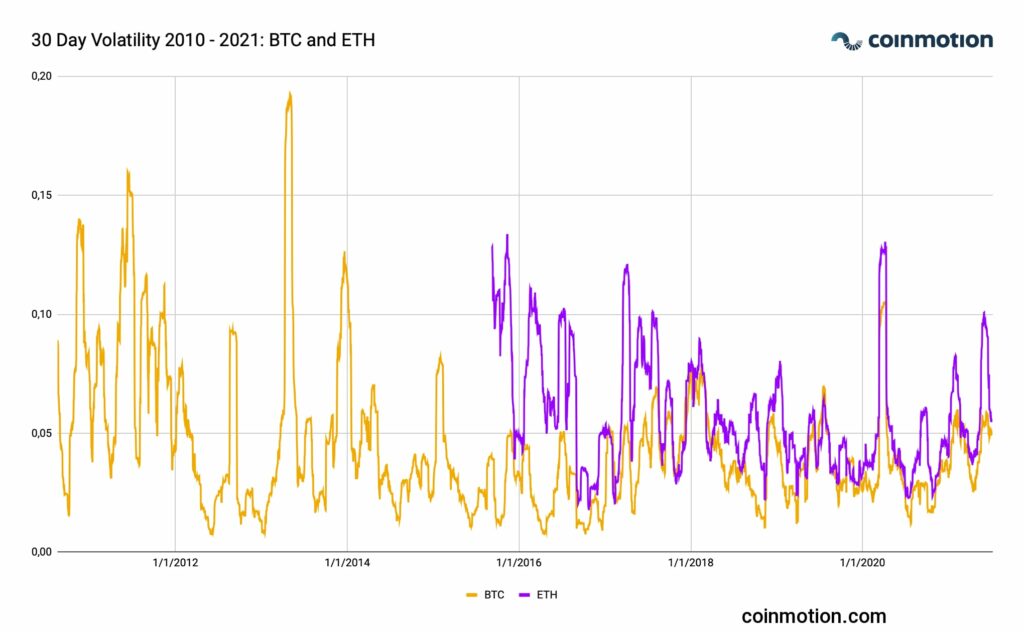

Despite the seemingly volatile markets in early to mid-2021, bitcoin’s historical volatility is factually decreasing. When exploring historical 30-day volatility data from 2010 to 2021, we can see a clear descent in average volatility, dropping from 2011 0,083 to 2020 0,035.

Bitcoin’s average (30d) volatility by year:

2011: 0,083

2012: 0,035

2013: 0,058

2014: 0,039

2015: 0,032

2016: 0,023

2017: 0,044

2018: 0,042

2019: 0,036

2020: 0,035

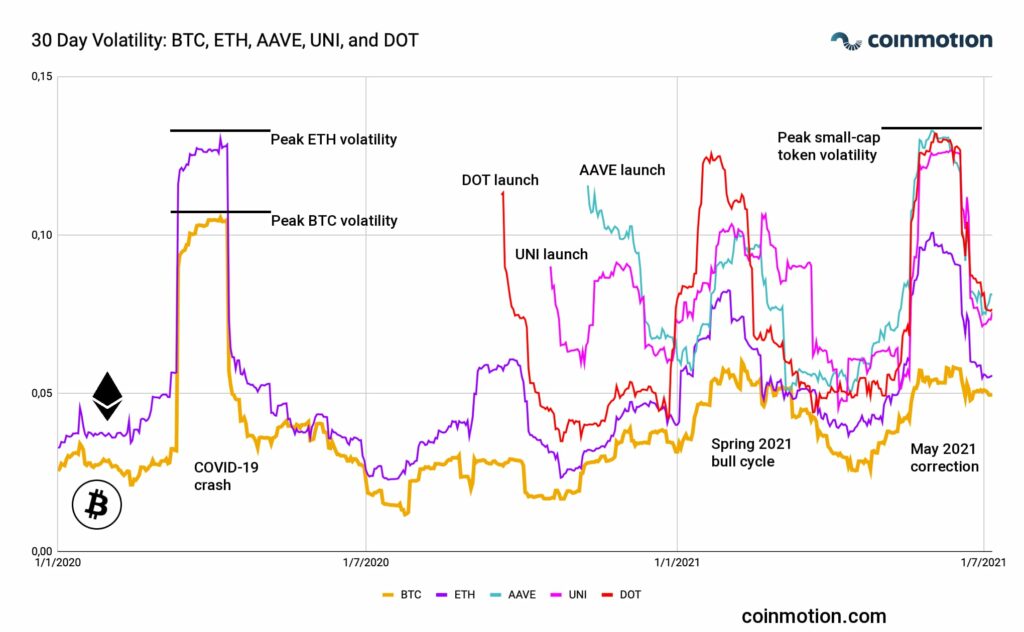

Let’s explore the shorter timeframes. As mentioned before, the volatility of bitcoin has dropped systematically. However, the volatility of small-cap tokens remains high. In this context, small-cap token refers to newer decentralized finance (DeFi) assets like Aave (AAVE), Polkadot (DOT), and Uniswap (UNI).

These three reference assets were all launched during the second half (H2) of 2020. Their price action has been weakly correlated with bitcoin since. In the following chart, the volatilities of Bitcoin (BTC) and Ethereum (ETH) peak in the early 2020 COVID-induced crash. Then, the volatility of both assets stays relatively low after spring 2020.

In early-to-mid 2021 the freshly launched small-caps showcased escalating volatility during the spring bull cycle and later during the May correction.

Volatility can be approached from another direction, as traders prefer volatility. In fact, volatility is necessary for short-term traders as they interpret the price action and aim to maximize their profits.

The cryptocurrency market offers a selection of different assets for different investor segments. “Legacy” cryptocurrencies are a good fit for long-term holding, carrying less risk. In turn, newer, small-cap, and DeFi tokens are preferred by more speculative investors.

Re-Emerging Altseason? Uniswap (UNI) Rises >38% in a Week

As mentioned in the previous chapter, small-cap volatility also creates opportunities for fast, speculative traders. Uniswap (UNI) ascended a whopping +38,23 percent within the second and seventh day of July. Multiple analysts estimate that the market has reached the bottom, and smaller altcoins are by default the first ones to emerge during a new bull cycle.

A Sharp Increase in Bitcoin Shorts

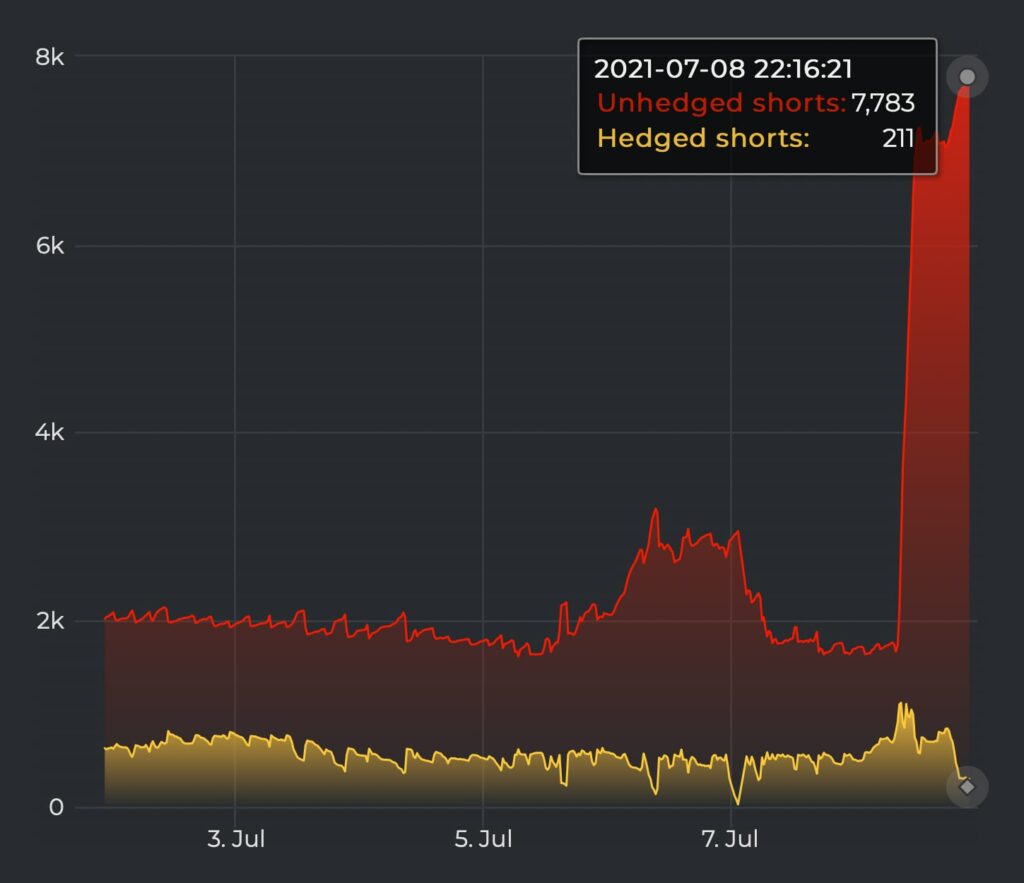

The amount of bitcoin shorts has been increasing this week from Monday’s 1781 contracts into later week 7783 contracts. Hedged shorts decreased from early week 505 contracts into 211 contracts. The bears, or bearish investors, within the bitcoin market anticipate the Grayscale GBTC to affect market sentiment significantly.

GBTC is expected to have an unlocking event next week (18.7), resulting in a release of 16 240 bitcoin units (BTC).