With so much emphasis on investing, many forget there are a plethora of ways to earn money in the cryptocurrency industry. Whether a beginner or an expert, this article looks at the many ways that you can start to earn passive income with crypto and enhance your bitcoin and crypto investing. Passive income can enhance the financial results investors get from highly volatile digital currencies.

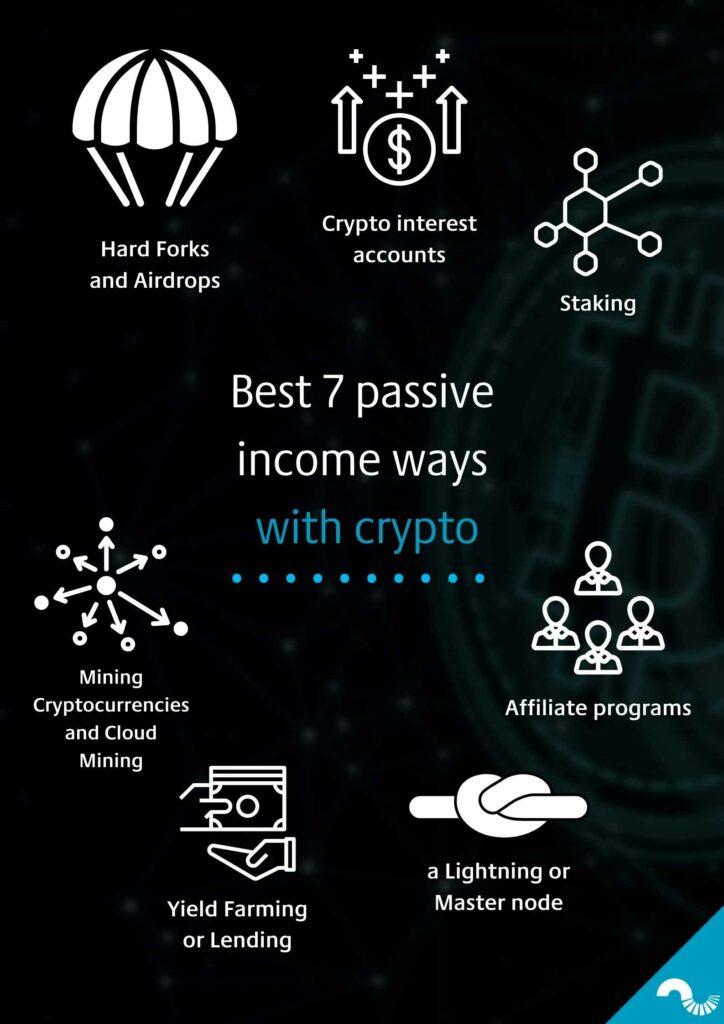

Best 7 passive incomes ways with crypto

- Mining Cryptocurrencies and Cloud Mining

- Staking

- Yield Farming or Lending

- Crypto interest accounts

- Affiliate programs and Blockchain-based content creation platforms

- Hard Forks and Airdrops

- Running a Lightning or Master node

Mining Cryptocurrencies and Cloud Mining

One of the oldest and most established ways to generate passive income with cryptocurrency is through the mining process. When mining, users supply blockchain networks with computing power in order to help secure the network. Unlike other ways of earning passive income, mining does not require a user to have any cryptocurrency holdings.

In the beginning, Bitcoin could be mined relatively efficiently. Back then, all one needed was an ordinary Central Processing Unit (CPU) housed within an everyday home computer. As the hashing rate, and subsequent power, increased, the network required more powerful equipment in order for users to earn block rewards and make a profit. Many companies then developed Application-Specific-Integrated-Circuits (ASIC) that could more quickly process the computations necessary to mine specific blockchains.

Today, the ASIC-dominated market and mining farms have increased competition making it difficult to secure a profit on many blockchain networks. Still, smaller Proof-of-Work (PoW) blockchains can be mined with more affordable equipment making it possible for users to earn passive income.

Another alternative that has arisen is cloud mining. Cloud mining, a controversial method in the industry, enables users to mine with a pool of others without maintaining mining hardware. Providers of cloud mining services charge a daily maintenance fee for their cloud mining contracts.

Earn Passive Income with Crypto: Staking

Staking is an appealing alternative to mining as it is far less resource-intensive. This income method, however, will require an upfront investment in staking tokens in order to participate. Staking requires users to keep staked funds in a digital or offline wallet. The funds, in turn, help maintain and perform different functions on the network. Blockchain networks with staking schemes use a Proof of Stake (PoS) as their consensus algorithm.

One major benefit of staking is that it is a relatively hands-off experience. Many exchanges and networks will work to take care of the technical requirements for you after you have staked the coins. Staking can be an effective way to earn passive income with crypto easily. At the same time, it is important to research the network, its history, and financial projections. This way, one can ensure that the promised staking reward projections are accurate.

Yield Farming or Lending

If a user is a long-term holder of a cryptocurrency asset, they might consider lending or yield farming. In contrast to both mining and staking, lending is a completely hands-off method. Lending enables users to earn interest on lent cryptocurrency holdings.

Users can employ any number of peer-2-peer (P2P) lending platforms to set aside their funds for a contracted period. Later, users collect interest payments there. Interest rates can vary. They can be set either as a fixed rate by the platform or negotiated by the user as determined by the current market rate.

The only downside to consider with lending is the possibility of bugs. That is, coding errors could disrupt the execution of the smart contract that your funds are locked into.

Crypto interest accounts

The lending market offers, perhaps, the easiest way to get into crypto for users who are wary of the volatility. People can earn interest on Bitcoin, Ethereum, and other major cryptocurrencies — alongside other coins that are emerging in the decentralized finance space. New users can make their initial investment in stablecoins — and open an interest account for a fixed or flexible amount of time.

The funds are lent, and the users get some ongoing income — the interest payable. Depending on the lending service provider, users may need to pay transaction fees. This is, in short, how a crypto interest account works.

Read about the Coinmotion cryptocurrency interest accounts.

Affiliate programs and Blockchain-based content creation platforms

Social media aficionados and influencers might try participating in rewards offered by crypto businesses. The idea behind this is to help get new users on their platform. Businesses might ask users to help them through referrals, testimonials, and by providing affiliate links. Such links encourage new adoption through discounts provided to the users who sign up through these campaigns. Users interested in promoting a product should do thorough research to ensure that the project is of a quality they are comfortable sharing.

Read about the Coinmotion referral program.

Likewise, users can earn money by running any number of content creator projects through the various platforms made possible by distributed ledger technology. Artists, crafters, and other bespoke product producers can monetize their creations through circulation on the blockchain network.

Hard Forks and Airdrops: Earn Passive Income with Crypto

Hard forks occur when a blockchain protocol changes to create a new blockchain that runs parallel to the original. A good example of this was the 2017 Bitcoin hard fork that created Bitcoin Cash. Users who invest in a blockchain before a hard fork will automatically receive the tokens of the new blockchain.

Airdrops occur when crypto projects directly deposit tokens into a user’s wallet. These are often given in exchange for bounties, social media promotion, and other campaigns that are designed to encourage user adoption.

Running a Lightning or Master node

For the technically savvy user, running a lightning node can be a smart way to benefit from advancing cryptocurrency technology. Though this may require more effort on the part of the user, it can be a rewarding method for earning passive income.

Lightning nodes help power the Lightning network, the second layer protocol that runs on top of existing blockchains such as Bitcoin. The lightning network allows for quicker transactions and provides higher security. That is why the network requires both payer and payee to agree to the terms of a smart contract before executions.

By running a lightning node, a user increases the liquidity and the capacity for the lightning network to produce payment channels. Users collect the network fees of the transactions that pass through their channels. The overall profitability of running a lightning node is still to be determined by the long-term adoption of the lightning network.

In contrast, masternodes run within the original blockchain. Furthermore, masternodes provide the functionality to the network in a way that other nodes do not. Running masternodes can be inhibitively expensive as they require a large front of crypto holdings to implement. Some can be so expensive that even after returns, the investment is illiquid. Combined with the need for technical expert set-up, running a masternode is not recommended for beginners.

Earn Passive Income with Crypto: What to Keep in Mind

It is important to remember that the cryptocurrency and blockchain industry is still in its infancy. They give a lot of exciting ways to earn passive income with crypto — with that comes certain responsibilities. In general, users should research and consider the assets that they are engaging with. A substantial project with a clear and transparent development plan and proven track record is often a better bet. This goes for almost all of the money-making items discussed above.

Similarly, engagement with all new technologies comes with the risk of bugs. Errors in executed smart contracts, be it staking or yield farming, could end with a loss of irretrievable funds.

A user should be diligent in following the industry and approach all investments with a curiosity and eagerness to engage. Certain features and money-making methods we discussed can be challenging to manage if the user lacks technical competence.

To avoid user error, it is best to wait until engagement with such features becomes easier. Another option is to try out other ways to earn passive income with crypto that can be more easily monitored.

Stay in the loop with our newsletter:

The views, thoughts, and opinions expressed in the text belong to the author and not necessarily to the author’s employer, organization, committee, or other group or individual.