The technical analysis for week 30 takes a deep dive into BTC’s unexpected price action and the recent bitcoin short squeeze.

Sentiment Shifts from Bearish to Bullish: Bitcoin Short Squeeze

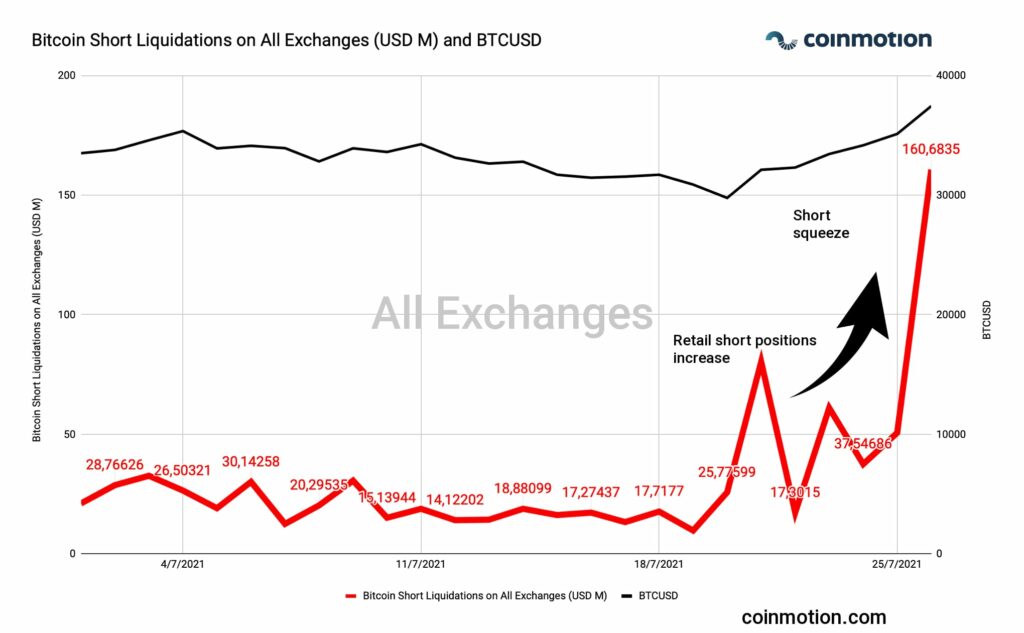

The famous meme “shorting bitcoin is bad for your health” was confirmed this week, as bitcoin shorters were wrecked again by unexpected price action. Particularly the retail segment’s short sellers have been accumulating short positions throughout July, setting a perfect storm for a speculative short squeeze.

Short contract liquidation data for exchanges, including Bitfinex, bitFlyer, BitMEX, Binance, Bithumb, Bittrex, Coinbase, FTX, Gemini, Huobi, KuCoin, OKEx, and Poloniex, shows over 160 million dollars (USD) worth of liquidations on Monday (26.7). The 160 million represent the highest daily liquidation since May’s correction and volatility.

What Is a Short Squeeze?

Short squeeze refers to a situation where the price of an asset quickly increases, usually followed by a significant amount of short exposure. Short-sellers borrow shares of an asset they estimate to decrease in price, planning to purchase them after the drop. If short-sellers are right, they return the shares and pocket the price difference between pre-short and after-short levels. If the short sellers are wrong, they are forced to buy at a higher price and pay the price difference. While profitable when implemented correctly, short-selling contains a risk of unlimited loss for shorters.

In a short squeeze situation, the price of an asset (in this case BTCUSD), rises rapidly, and short-sellers are forced to cover their positions by purchasing more of the said asset. The combined buying pressure from organic buyers and short-sellers covering their positions can lead to a parabolic advance.

- Short squeeze breakout

- Position covering

- Parabolic advance, a possibility of unlimited loss for short-sellers

- Short squeeze top

Bitcoin Hits $48K on Binance Perpetual Swap Contract

Amid the short squeeze, Binance Perpetual Swap (BTC/USD) contract hit 48 000 USD, marking a possible market direction. The market sentiment seems to show derivative and future (retail) traders being bearish and long-term bitcoin holders bullish. Bitcoin bulls took a short-term victory in this battle.

Bitcoin Short Squeeze as Part of a Growing Trend

Arranged short squeezes are becoming an increasingly popular phenomenon. In January this year, retail-based short squeezers attacked institutional GameStop (ticker: GME) short-sellers by buying vast amounts of GME stock, mainly using their mobile devices. These short squeeze mayhems were arranged on the r/wallstreetbets subreddit and other social media, supplemented by popular influencers like Elon Musk.

is it normal to go +42.47% after hours? pic.twitter.com/b8FqPUvEJb

— @mikko (@mikko) January 27, 2021

Institutional investors could not forecast the short squeeze risk coming from a new direction, and massive losses, most notoriously for Melvin Capital, were incurred. By the recent data, Melvin Capital is still -46% in the first half (H1) of 2021, and its assets declined -49% in the first quarter (Q1) alone.

Retail Shorters Against Whales

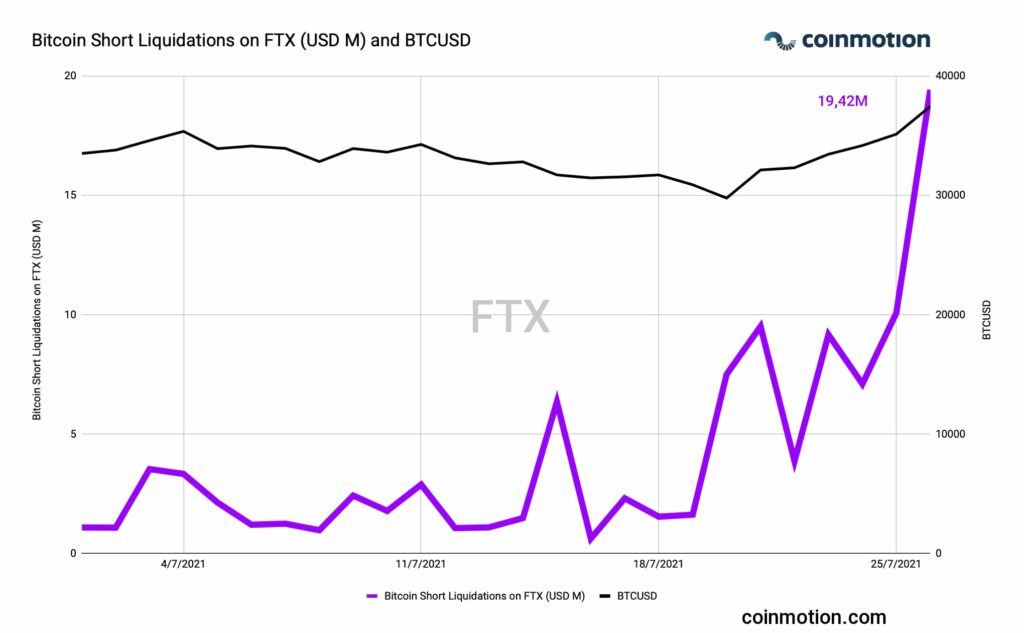

The setting leading to short squeeze was composed of retail traders shorting bitcoin heavily, offering a perfect position for a whale-induced short squeeze. FTX exchange, popular among the retail segment, shows 19,42 million USD worth of liquidations during one day.

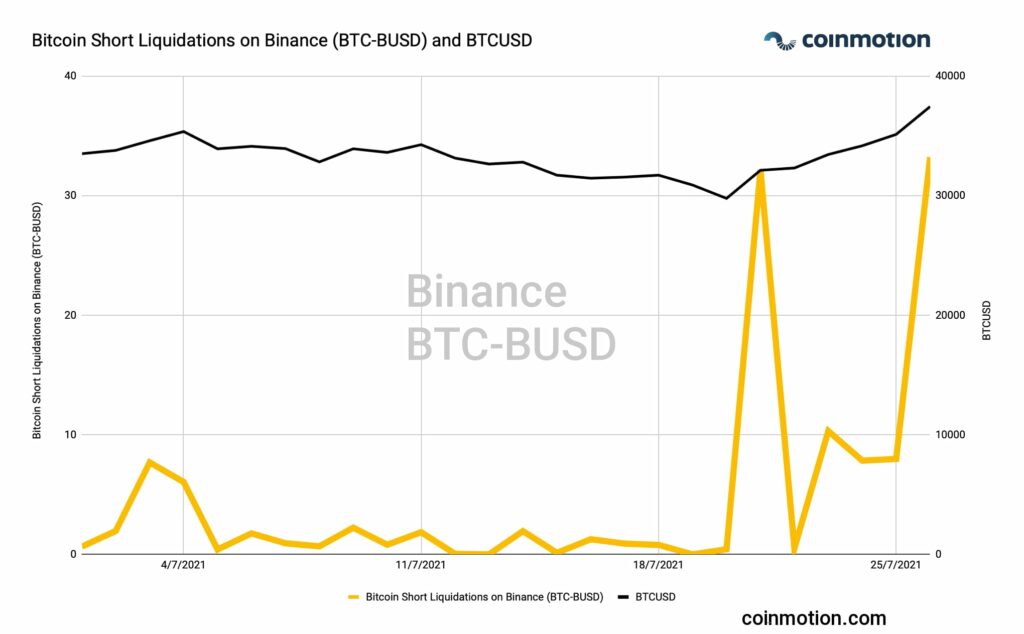

Binance was also among the exchanges with high short liquidation, recording 36,63 million dollars (USD) worth of liquidations. Binance’s BTC-BUSD pair had the highest amount of liquidations ever, rising to 1,25 million USD. BUSD is Binance’s stablecoin, called Binance USD, increasingly used as a trading pair for bitcoin.

Massive Decrease in Exchange Bitcoin Balance

Bitcoin reserves held by major exchanges have been declining sharply since last week, dropping approximately 100 000 bitcoin units from 2,51 million BTC into 2,41M. There are multiple theories on this phenomenon: Some speculate that clients would be withdrawing their assets from Binance, anticipating a forthcoming regulatory crackdown. Some interpret the reserve drop to be internal exchange wallet transactions. The exchange reserves have not been this low since April this year.