In this week’s cryptocurrency technical analysis, we examine the latest market trends. What is happening to the BTC price, and what is institutional investors’ next move?

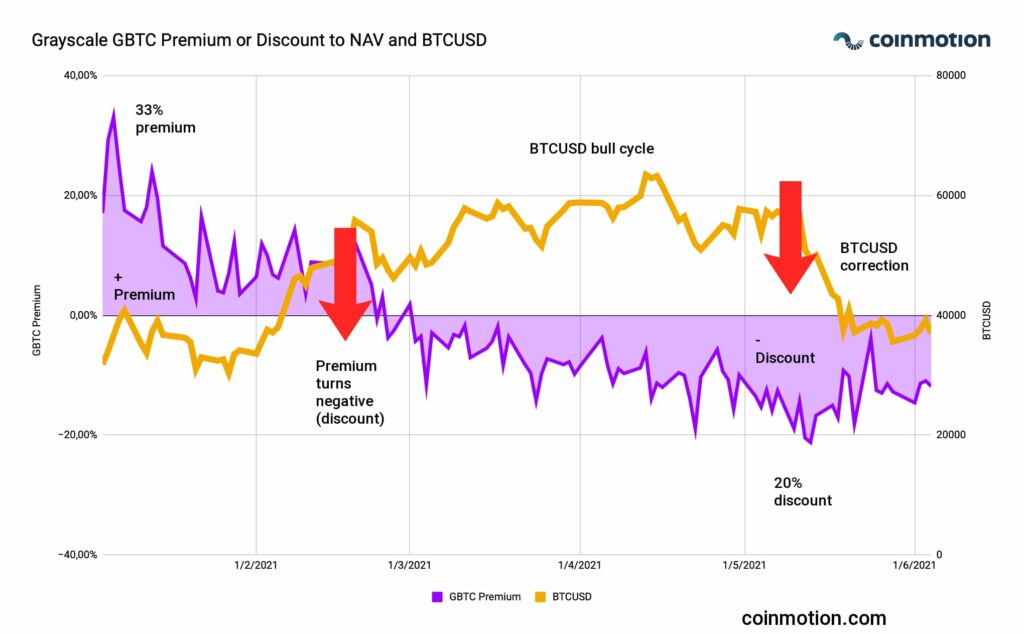

Grayscale GBTC Premium as Leading Indicator

Grayscale’s GBTC fund (Grayscale Bitcoin Trust) is likely the most famous financial product within the cryptocurrency scene, and consequently, it has an enormous impact on the market. Grayscale’s AUM (assets under management) has recently reached 32,2 billion dollars (USD). GBTC is the biggest Grayscale fund by a large margin, and its AUM represents over 70 percent of all Grayscale’s AUM.

The vast majority of Grayscale’s clients are institutional, and hedge funds play heavily in the game. Hedge funds have specifically used GBTC for arbitrage trades, which are implemented in the following order. Hedge fund borrows bitcoins and invests them in GBTC, receiving GBTC shares in return.

GBTC previously had a notably high premium. Hence, GBTC shares have been more valuable than the invested bitcoins themselves. After a six-month lockup period, hedge funds can sell the GBTC shares with a considerable profit margin. The yearly management fee for GBTC has been 2%.

The GBTC arbitrage trade worked well before March 2021 as GBTC’s premium turned into a discount. In other words, Premium turned negative (red arrow on the left). The shifting premium represents a significant paradigm shift for GBTC, which had a 132,6% premium in May 2017. In early 2021 GBTC’s premium surpassed 33%.

While Grayscale enjoyed an exclusive position before, it nowadays has to compete with e.g., Canadian ETFs that offer lighter cost structures and easy access.

In May, the GBTC discount reached 20%, and bitcoin’s price (BTCUSD) followed the GBTC premium down. I think there’s a clear correlation between GBTC premium and bitcoin’s price, yet it doesn’t have to be a perpetual trend. Grayscale is planning to convert its GBTC fund into an ETF. Besides, MicroStrategy and similar technology companies are bringing buying pressure to the scene.

Bitcoin and The Possible “Death Cross”

Bitcoin is quickly approaching a so-called “death cross” pattern, which means the crossing of 50-day moving average (50 DMA — or daily moving average) and 200-day moving average (200 DMA). In short, seeing a “death cross” may indicate the start of the bear market.

The chart shows 50 DMA as red and 200 DMA as purple.

The bitcoin “death cross” has occurred previously, too, with a tendency to appear after a long(ish) bull cycle. In these cases, bitcoin has seen a downward correction after the “death cross,” usually spanning over 50 percent. On Thursday morning (10.06.2021) BTCUSD was seen to recover again, rising more than 10% within 24h time frame. If bitcoin’s price manages to maintain positive momentum, we will avoid the “death cross.”

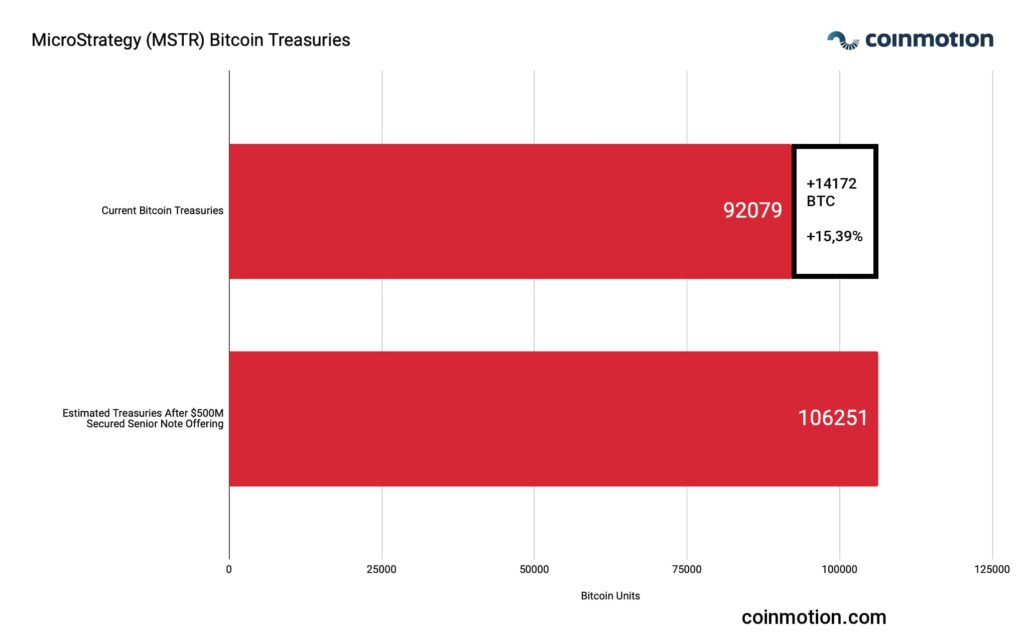

MicroStrategy Continues Bitcoin Buys with a $500 million Allocation

Michael Saylor’s MicroStrategy (MSTR) announced a new $500 million bitcoin allocation to be funded with a new corporate loan. MicroStrategy currently holds 92 079 bitcoins in its balance sheet, and a $500 million bitcoin allocation would equal 14 172 bitcoin units by current BTCUSD. MSTR’s bitcoin treasuries would grow to 106 251 units after the recent announcement, rising by +15,39 percent.

MicroStrategy has been accumulating bitcoin since July 2020, as its CEO Michael Saylor announced MSTR to explore purchasing bitcoin, gold, and other alternative assets instead of holding cash (USD). Saylor sees bitcoin as “hard money” and a store of value (SoV). Additionally, he’s mainly indicating using bitcoin as an instrument to hedge global currency devaluation, technology disruption, social dislocation & political uncertainty.

Latin America Embraces Bitcoin

El Salvador stirred the markets this week by announcing a new liberal national bitcoin regulation. El Salvador’s parliament has approved a new law, which grants bitcoin a legal payment method status. According to the new regulation, people can use bitcoin for paying taxes, and bitcoin capital gains are tax-free. Merchants must accept bitcoin if there’s no force majeure. El Salvador still used the U.S. dollar (USD) for accounting purposes as it remains the official national currency.

Later, El Salvador announced to offer citizenship to anyone who confirms the possession of three bitcoins (BTC). There seems to be undisputed demand for gold-like scarce assets in Latin America, as the area is notorious for weak (FIAT) national currencies. As a reference, the Argentine peso (ARS) lost over 80% of its value against USD between 2018 and 2019.