The second year of the COVID-19 pandemic is drawing to a close. The first half of this year has been extremely eventful. COVID-19 vaccines are being issued around the world, possibly bringing the end of the pandemic into sight. For the financial world, H1 2021 has also been eventful. For crypto — even historic. As H1 is behind us, here are the most important crypto trends of 2021 so far.

Crypto Trends 2021 for Investors

- The explosion of DeFi

- NFT-o-Rama — non-fungible tokens have arrived

- Institutional investors see Bitcoin as a hedge against inflation

- Central bank digital currencies (CBDCs)

- The rise of retail investors

- Stablecoins disrupt the world of traditional payments

- More consumer-facing crypto products

- The crypto mining industry finds a new home in…Texas?

- Bitcoin turns into a reserve asset for sovereign nations

- Crypto fund inflows are reaching new all-time highs

#1: The Explosion of DeFi

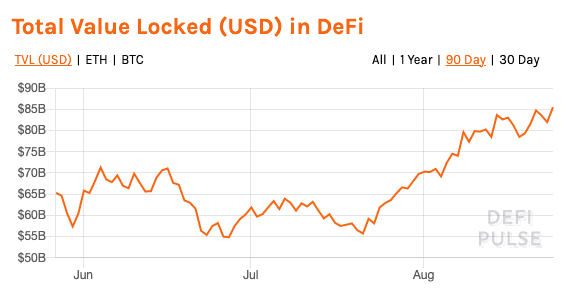

Activity on the decentralized finance (DeFi) front began to see a major pickup in the summer months of 2020. Throughout June, July, and into August, some DeFi token prices saw triple-digit percentage jumps. However, DeFi’s gains in summer 2020 were nothing compared to the first quarter of 2021.

Since the beginning of the year, the amount of capital being used in DeFi protocols–also known as “total value locked (TVL)”–was roughly $16 billion. As of August 24th, 2021, DeFi’s TVL was over $85 billion, increased by over 400 percent.

What has drawn all of this new money into DeFi? The exact reasons aren’t clear. However, opportunities to earn passive income in the DeFi space seem to be an essential factor. Staking, yield farming, and lending are just a few (not to mention the impressive price-performance that many DeFi tokens have continued to display.)

In spite of (or perhaps because of) all of the hype around DeFi, critics have compared it to the initial coin offering (ICO) boom of late 2017. However, DeFi enthusiasts claim that there are some key differences between the ICO era and the DeFi age. Specifically, DeFi has brought higher-quality projects, a better understanding of blockchain’s use cases, and a savvier investment base.

DeFi is growing so fast that many developers have sought alternatives to the Ethereum network, the original “backbone” of the DeFi industry. This has caused increased interest in other smart contract-enabled blockchains, such as Polkadot (DOT) and the Binance Smart Chain (BNB).

#2: NFT-o-Rama — Non-Fungible Tokens Have Arrived: Crypto Trends 2021

One of the things contributing to the DeFi space’s growth is the rise of non-fungible tokens or NFTs.

If you haven’t heard already, NFTs are digital collectables. Just like a one-of-a-kind painting or super-rare, unique Pokemon card in the “real world,” no two NFTs are alike. This is what “non-fungible” means: assets that are non-fungible cannot be traded interchangeably for one another.

NFTs have been around for several years, but it seems like they are finally having their “moment” in 2021. In March, a number of high-profile artists and celebrities pulled in millions of dollars in NFT sales. Canadian musician Grimes pulled in $6.6 million in an NFT drop at the beginning of the month. American visual artist Beeple made $69 million from the sale of a single NFT. Even John Cleese got in on the fun.

All of the attention on the NFT space has drawn quite a bit of criticism to the NFT concept. This criticism is not altogether unjustified. After a fake Banksy NFT sold for almost a million US dollars, smaller artists shared stories of their work being stolen and sold as NFTs.

Some artists are concerned about the environmental impact of NFTs, though there is some debate over the carbon footprint of creating an NFT. Despite the controversy, many analysts seem to agree that NFTs aren’t going anywhere anytime soon.

#3: Institutional Investors See Bitcoin as a Hedge Against Inflation: Crypto Trends 2021

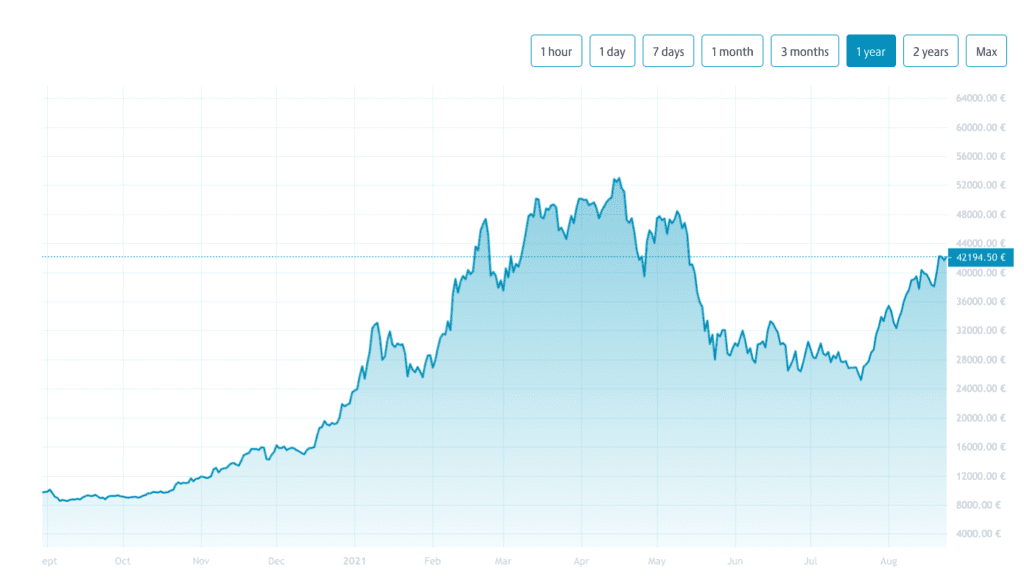

As the COVID-19 pandemic has continued through the first quarter of 2021, governments around the globe are still seeking ways to stave off economic recession (or even depression).

As a result, money printers have continued to go “brrr,” as many crypto enthusiasts love to say. In other words, quantitative easing has continued–particularly in the United States. This has shaped one of the 2021 crypto trends.

Because of this rapid increase in the number of dollars in circulation, many economic analysts have predicted that USD inflation could be in the cards over the next several years. These concerns over fiat inflation have caused many investors and money managers to seek assets that display anti-inflationary properties. For some, this quest led to investment in gold; for an increasing number of others, however, it led to Bitcoin.

Indeed, many high-profile institutional investors and corporations have added BTC to their balance sheets this year: Microstrategy, Tesla, Square, and Stoneridge, to name a few. Paul Tudor Jones also described BTC as “the fastest horse” in the race against inflation.

#4: Central Bank Digital Currencies (CBDCs): Crypto Trends 2021

Central Bank Digital Currencies, or CBDCs, are not a new concept for crypto. However, some analysts have said that this year may bring the first large-scale CBDCs to market.

Throughout 2020, the list of countries and supranational entities that began exploring CBDCs grew considerably. Data from Remitano in March 2021 listed more than 40 countries in the “exploration” phase of CBDC development, including the United States and the United Kingdom. Twelve countries had moved onto the “pilot” stage.

What effect could these CBDCs have on crypto markets as we know them? It’s unclear. However, Thomas Trepanier, Director of Business Development for Roxe at Apifiny, said in November 2020 that “embracing the CBDC will help break down the phobias and barriers that many have toward cryptocurrencies.”

#5: The Rise of Retail Investors: Crypto Trends 2021

If there’s any significant change that 2021 has brought to all financial markets, it’s the realization of just how much power retail investors have.

It all started in February when a group of rogue traders on the r/WallStreetBets subreddit banded together to “squeeze” hedge funds on Wall Street. The traders began to pump millions into GameStop (NYSE:GME) and several other “meme stocks.” Soon after, they went for Dogecoin (DOGE).

Since then, retail investors have learned how much power they have in crypto markets and beyond. The rest is history.

#6: Stablecoins Disrupt the World of Traditional Payments: Crypto Trends 2021

Stablecoins have gained serious traction as a means of settling transactions. In traditional finance, using credit cards, bank transfers, and convenient payment services require middlemen as facilitators–a factor that can be both costly and slow.

Blockchain technology made it possible to send value across borders without intermediaries securely. However, cryptocurrencies like bitcoin (BTC) and ether (ETH) were considered too volatile to be used as a means of reliable cross-border transactions by banks and other institutions.

At the same time, stablecoins have steadily gained popularity to store value securely in the crypto sphere. Many individual traders have used stablecoins to “park” the value of their cryptocurrencies in off trading hours and send crypto between trading accounts for years. But 2021 was when stablecoins began gaining popularity as a means of exchange for institutions for the first time.

In March, Payment card network Visa announced that some of its transactions could be settled on the Ethereum using Circle’s USD Coin (USDC). Then, in July, Mastercard announced a partnership with Evolve Bank & Trust, Paxos Trust Company, and Circle. Mastercard began accepting USDC from card issuers through the partnership and then exchanging it for fiat currency before settling transactions with merchants. This makes it easier for firms issuing crypto-cards to make direct crypto-to-fiat conversions.

#7: More Consumer-Facing Crypto Products

2021 was the year that the New York Times declared that “we’re all crypto people now.” The Times was referencing the successful completion of Coinbase’s IPO–but the claim went much deeper.

Indeed, it seems that the cryptocurrency industry is entering a new phase of development. The first ten years of crypto were about building the “backend” of the industry: deep, highly technical products that were focused on developers and professional traders. Now, more crypto products are targeting a new group of users: everyday people.

For example, Nischal Schetty, chief executive of cryptocurrency exchange WazirX, told CNBC’s “Make It” that “The next several years…will be about building consumer-facing crypto products. Right now, it’s still not really into the hands of the people.”

#8: The Crypto Mining Industry Finds a New Home in…Texas?

The bull market that started the year 2021 came to a screeching halt in May. While an over-abundance of highly-leveraged positions was ultimately declared as the main cause of the crash, another factor was identified as an important trigger: China’s regulatory crackdown on cryptocurrency mining.

Indeed, the South China Morning Post declared that “Local governments across mainland China have…[pushed] out cryptocurrency miners, forcing some of these enterprises to seek a new home overseas.” Their main destination? Texas.

Indeed, despite the catastrophic power grid incident last winter, Texas often has some of the world’s lowest electricity prices. Additionally, the state is steadily sourcing more and more of its electricity from renewable sources: as of 2019, 20% of its power came from wind.

Crucially, the state’s political leaders are very pro-crypto. In May, the state’s Governor Tweeted to “count [him] in as a crypto law supporter.”

Count me in as a crypto law proposal supporter.

— Greg Abbott (@GregAbbott_TX) March 29, 2021

It is increasingly being used for transactions and is beginning to go mainstream as an investment. (Fidelity, etc. trying to get Bitcoin ETF).

Texas should lead on this like we did with a gold depository. https://t.co/1z25mtgnmu

#9: Bitcoin as a Reserve Asset for Sovereign Nations: Crypto Trends 2021

For years, many of bitcoin’s earliest adopters and advocates predicted that BTC would one day become a currency used and accepted by countries around the globe. To many, this prediction seemed to be nothing more than a pipe dream. That is, until this year.

Nayib Bukele, the President of El Salvador, declared in June in a national address that bitcoin would officially become legal tender in the country on September 7th.

Shortly after, a bill appeared in Paraguay. If passed, the bill would make the nation the second to embrace Bitcoin as legal tender. Carlitos Rejala, a member of Paraguay’s parliament, wrote on Twitter that “[…] Our country needs to advance hand in hand with the new generation. The moment has come, our moment. This week we start with an important project to innovate Paraguay in front of the world!”

As I was saying a long time ago, our country needs to advance hand in hand with the new generation. The moment has come, our moment. This week we start with an important project to innovate Paraguay in front of the world! The real one to the moon #btc & #paypal https://t.co/bQll07NnET

— Carlitos Rejala 🙏🇵🇾🙌 (@carlitosrejala) June 7, 2021

Around the same time, Tanzanian President Suluhu Hassan told the nation’s financial leaders to prepare for the advent of cryptocurrency: “We have witnessed the emergence of a new journey through the internet,” she said. “I know that throughout the nation, including Tanzania, they have not accepted or started using these routes. However, my call to the Central Bank is that you should start working on that development.”

#10: Crypto Fund Inflows Are Reaching New All-Time Highs

By the end of 2020, the amount of institutional assets under management (AUM) allocated to crypto was $15 billion. This represented an increase of more than 700% from the end of the previous year, which saw just $2 billion in institutional AUM.

As such, the amount of institutional dollars in crypto funds is expected to increase significantly throughout 2021. In July, Reuters reported that “71% of institutional investors say they will buy or invest in digital assets in the future–and over half already do.”

Watch This Space for Crypto Trends of 2021

It certainly has been an eventful quarter for the cryptocurrency sphere. However, the year is only halfway gone. Stay tuned–Coinmotion is always there to help you participate in all of the hottest 2021 trends in crypto.