During the last few years, investing in cryptocurrencies has grown in popularity. Many people even consider buying crypto for their children to invest in their future. In fact, in 2021, some analysts believe that adding cryptocurrency to your portfolio is a must. Still, the process can be intimidating–particularly for inexperienced retail investors because they don’t know how to invest in cryptocurrency.

Before you invest in cryptocurrency, there are two main factors to consider: the kind of digital assets you are interested in purchasing, as well as your trading strategy.

How to invest in cryptocurrencies — step-by-step:

Choose what crypto you want to invest in

Choose a trusted crypto platform

Register there and verify your account

Deposit funds and buy crypto

Decide how you want to store your assets

Decide what is your investment strategy and goals

Choosing the right strategies to invest in cryptocurrency

There are many different investment strategies that investors can take advantage of to profit in cryptocurrency markets.

Traders who have experience with technical analysis and knowledge of financial markets can try their hand at day trading; other traders enlist the help of bots that automatically buy and sell for them.

Cryptocurrency traders with a basic level of technical skill and knowledge of markets may wish to buy and sell crypto options based on trends. For example, traders can choose to sell their assets when their value falls below a certain level and re-buy when their value rises once again. However, without knowledge of markets or how to trigger buy and sell orders automatically, even basic trading strategies can be tricky.

Additionally, buying and selling cryptocurrencies triggers a taxable event in many countries. That’s why some investors may wish to avoid exchanging their digital assets as much as possible.

Therefore, many investors are most attracted to what may be the oldest and least complex trading strategy of all: hodling.

HODLing: The Simple, Tried-and-True Method of Holding Onto Your Coins No Matter What

The market caps of bitcoin and other cryptocurrencies have grown large enough that their prices aren’t as easily moved as they were several years ago. Meanwhile, price volatility is still a major factor to consider when you decide to invest in cryptocurrency.

Some professional traders have learned how to benefit from this volatility. By creating trading bots and similar tools, one can profit from the moment-by-moment upward and downward movements of cryptocurrency markets.

Other professional traders have developed analytical tools that help to define when they should buy or sell an asset. However, most of us are left with nothing but our wits. Recognizing this truth, one bitcoin investor made a post on the Bitcoin Talk forum–and the world was never the same.

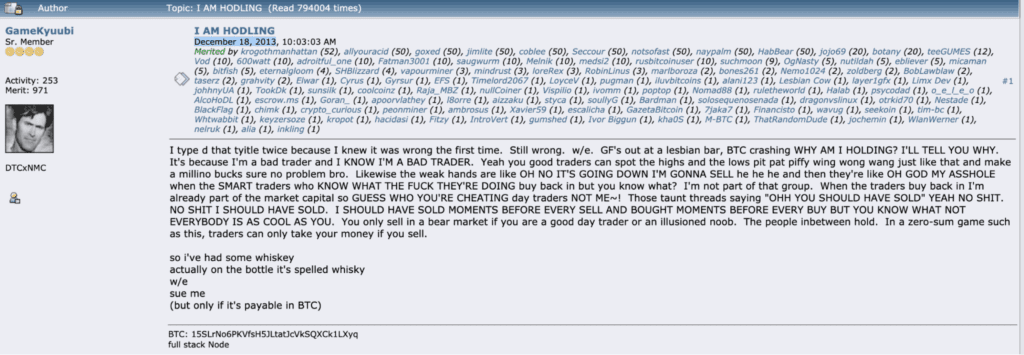

“I AM HODLING,” wrote Bitcoin Talk forum member GameKyubi on December 18, 2013. “WHY AM I HOLDING? I’LL TELL YOU WHY. It’s because I’m a bad trader, and I KNOW I’M A BAD TRADER.”

GameKyubi went on to explain that “hodling” means that he had decided not to buy or sell his bitcoins based on market movements; rather, GameKyubi decided that he was better off just waiting the movements out. So, “hodling” is exactly what it sounds like. Learn to hold onto your cryptocurrencies even when markets fluctuate strongly in any direction.

Taking an Average Position: Invest in Cryptocurrency Using “Smart Hodling”

Most commonly, investors who choose to HODL their assets will invest a large sum all at once before locking it up and throwing away the key. However, choosing the moment for this cryptocurrency investment can be difficult.

Let’s imagine that you have $10K to invest in bitcoin. If the market is at a new all-time high, the hype and euphoria surrounding the asset may tempt you into buying it right then and there.

Imagine, however, that two weeks later, the price has fallen by 15%. If you waited for those two weeks, you could get 15% more BTC for your buck. Imagine further that 90 days after BTC’s last all-time high, the price has fallen 40%. If you waited a few more weeks, you could get almost double the amount of BTC for the $10K investment.

The opposite can also happen. Imagine, once again, that you have $10K to invest. But, being a smart investor, you want to wait until the BTC price falls so that you have more buying power. However, two weeks later, the price of bitcoin is up by 15%; 90 days later, BTC is up 40%. While you were waiting for markets to drop, you lost almost half of your buying power.

There’s no way to know what is going to happen in the future. Therefore, many investors choose to spread out their investments into small installments over time. In this way, your cryptocurrency holdings are not quite so much at the mercy of the markets (in either direction); your purchases capture the average price of an asset over a period of time.

How often you want to invest in cryptocurrency is up to you. Many investors choose to put money into crypto weekly, bi-weekly, monthly, or bi-monthly.

Dollar-cost averaging vs Value-cost averaging

When it comes to deciding how much you would like to invest, there are two strategies that investors commonly use. They are dollar-cost averaging and value-cost averaging.

Dollar-cost averaging means that investors purchase the same dollar amounts of cryptocurrency at regular intervals. For example, if you decided to purchase $50 in BTC every other week–no matter how much the price of BTC had fluctuated–this would be a dollar-cost averaging investment strategy.

Value-cost averaging, on the other hand, means that an investor chooses to make their purchases based on their portfolio’s percentage gain or loss. Using this strategy, an investor sets a target growth rate over a given period of time. Then, the investor adjusts their next contribution in accordance with the relative gain or shortfall made on the original asset base.

For example, imagine that you have $2,000 in BTC. Say your goal is to increase the value of your portfolio by $200 every month. If the value of your portfolio rises to $2,050 in a month, you will fund the account with $150 ($200 – $50) worth of assets. If the value of your account had fallen to $1,950, you would add $250 to your portfolio.

Cryptocurrency investment Strategy: Choosing the Right Kinds of Investments for Your Crypto Portfolio

The cryptocurrency market as a whole is an incredibly nascent space. Bitcoin, the oldest cryptocurrency in existence, is less than 12 years old. Therefore, just as with any new market, investing in cryptocurrencies carries a relatively high level of risk. However, different kinds of assets can be relatively more or less risky within the world of cryptocurrencies.

Bitcoin

As the oldest and largest cryptocurrency by market cap, many investors consider bitcoin to be the least risky cryptocurrency to invest in. In fact, many analysts believe that bitcoin is so dependable that it may be a hedge against fiat currency inflation.

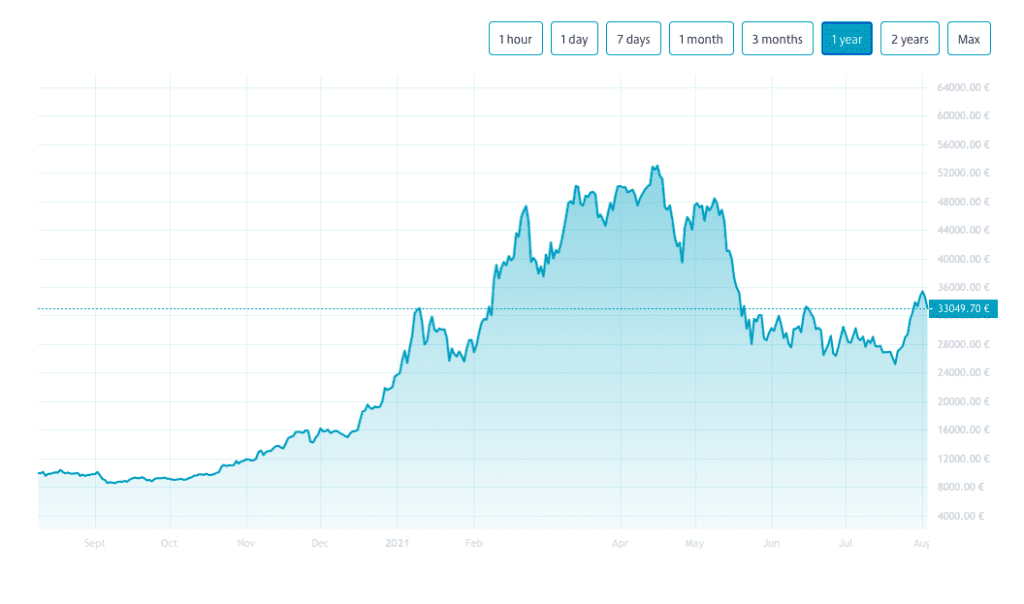

However, “least risky” is very much a relative term. For example, in the first half of 2021, bitcoin’s volatility was on full display. After starting the year around $30K, bitcoin nearly doubled its value with an astronomical rise to $60K. However, it wasn’t long before BTC did an about-face and fell almost all the way back to where it had started the year. Therefore, if you’re investing in bitcoin, keep in mind that these kinds of short-term price swings are still very much a part of the experience.

DeFi

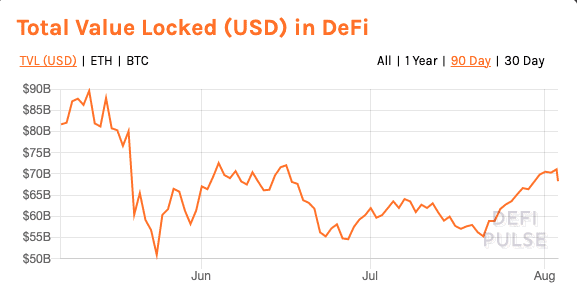

DeFi projects have decentralized platforms that provide traditional financial services in an autonomous manner without the involvement of a centralized third party. For example, some of today’s most popular DeFi projects offer their users loans, insurance, yield-generation, and more. Along with a major rise in the popularity of bitcoin, 2021 has been the year that decentralized finance (or DeFi) started to gain some serious traction. At the beginning of the year, there was $16 billion “locked” in the DeFi ecosystem. By August of 2021, that figure had increased to nearly $70 billion.

However, because most DeFi projects have market caps that are relatively smaller than bitcoins’, the prices of DeFi assets move easier with changes in the market. Therefore, generally, DeFi coins are considered to be on the riskier end of the cryptocurrency investment spectrum. The potential for loss is considerable. However, the potential for gain could also be vast.

Some of the most popular DeFi’s among investors are Aave, Link, and Uniswap.

- Aave: The leading decentralized (DeFi) cryptocurrency lending service. Aave is the native token of the Aave platform. It is an Ethereum-based erc-20 token.

- Link: Chainlink is an oracle service delivering data to blockchains. Link is the native token of Chainlink. The LINK token is an Ethereum-based erc-20 token.

- Uni: Uniswap is a leading decentralized exchange in the Ethereum network. UNI is the native token of Uniswap. The UNI token is an Ethereum-based erc-20 token..

However–just as with any investment–never invest more into DeFi than you can afford to lose. If you have a bit more technical experience within the cryptocurrency world, you may want to try Yield Farming.

NFTs: How to invest in cryptocurrency

Non-fungible tokens, or NFTs, emerged as one of the hottest cryptocurrency trends of 2021 in March. However, as cryptocurrency markets shed billions throughout May, NFT markets were also hit by an outflow of capital–hard.

As prices fell, the voices of NFT critics have grown louder: potential investors are concerned about the environmental impact of non-fungible tokens, as well as issues surrounding security and fraud. However, proponents of NFTs have argued that the problems surrounding NFTs are to be expected–that any nascent market has its own set of issues to overcome.

Still, non-fungible tokens are considered to be a high-risk investment.

Layer-1 Smart Contract Chain Coins

Layer-1 smart contract network coins like Ether (ETH), Solana (SOL), PolkaDot (DOT) are uniquely positioned in cryptocurrency markets.

These are the native tokens of the blockchain networks that are used for the basis of DeFi dApps, or decentralized applications. Because they function as the basis for dApps, these Layer-1 tokens play an important role and, therefore, may be less risky than DeFi coins.

However, because many Layer-1 blockchains use Proof-of-Stake algorithms, some of these assets may be inflationary. Unless a token-burn mechanism is implemented, more tokens will be added to their circulating supply every year. Therefore, these assets may sit somewhere in the mid-range of relative cryptocurrency investment risk.

Altcoins

Some of the most popular altcoins among investors are Stellar, Ripple, and Litecoin.

- Litecoin (LTC) is a cryptocurrency inspired by Bitcoin that powers fast and cheap money transfers

- Stellar Lumens (XLM) is a decentralized payment protocol allowing fast and cheap transactions between any pair of currencies that can be used by anyone from individuals to financial institutions.

- Ripple (XRP) is a digital currency that is used to facilitate fast transactions on the Ripple Network. Ripple aims to build a global payment network that all banks and financial institutions can use.

Stablecoins

Some stablecoins have their value tied to non-volatile currencies such as the U.S.

USD Coin (USDC) is a regulated stablecoin equivalent to the US dollar. Stablecoins are widely used in cryptocurrency trading in many marketplaces and earning a higher interest via a crypto interest account.

Whether it’s bitcoin, DeFi assets, NFTs, Layer-1 smart contract coins, altcoins, or stablecoins, always be sure that you do your due diligence before investing in any cryptocurrency. Additionally, make sure you are purchasing your digital assets from a reputable source. To learn more about how to get started in cryptocurrency markets, visit Coinmotion.com.

The following piece does not include any investment advice. It is worth noting that investing in any digital asset includes risks, which should be carefully assessed before making important decisions.